TaxAudit Blog: Tax Audits and Notices

Learn what IRS Notice CP134B means, why you received it, and how to resolve payroll tax discrepancies to avoid penalties.

IRS Letter 797 explains the Earned Income Tax Credit (EITC)—a refundable tax benefit that could mean a bigger refund. Learn why it’s good news.

Learn what IRS Letter 474C means, why you received it, and how to respond with confidence. Get expert tips to resolve tax issues quickly and effectively.

Received IRS Notice 106C? Learn what “Claim Partially Disallowed” means and how to respond if your Employee Retention Credit claim was audited.

Learn what IRS Notice CP15 means, why you received it, and how to respond or dispute the penalty to avoid further charges and resolve the issue.

If you’ve received an IRS CP215 Notice, Notice of Penalty Charge, you're not alone, and with the right steps, you can resolve the issue.

IRS Form 3531, titled ”Request for Signature or Missing Information to Complete Return,” is a notification that your tax return cannot be processed.

Received IRS Letter CP3219A? Learn what it means, why you got it, and how to respond before the deadline to avoid a tax bill.

IRS Letter 4364C explains changes to your Amended Return. Learn what it means, what to expect next, and how to respond effectively.

Have you just received an IRS CP24 Notice and do not know what to do? No need to fear! Let's go over what an IRS CP24 Notice is and how to respond.

One of the most common notices the IRS sends out is IRS Letter 2645C, also known as a “stall letter.” This notice does not typically require further action.

An IRS Letter 12C is requesting additional information to verify the claims made on your tax return. The request is typically included in the fourth paragraph.

IRS Notice CP75 is common for returns having refundable credits, such as the Earned Income Tax Credit. Every year, about 270,000 taxpayers receive the letter.

A CP14I is issued when the IRS believes you did not withdraw the required minimum distribution from your IRA or made excess contributions to an IRA.

IRS notice CP79 has two variations - a CP79 and a CP79A. It is important to note which one you have in your hands to better understand what is next.

IRS Letter 525 is sent to let you know that your tax return was reviewed. A wise taxpayer should proceed with caution, yet swiftly, from this point forward.

A CP08 is to let taxpayers know that they may qualify for the Additional Child Tax Credit and, in turn, could be eligible to receive a refund.

The IRS has issued a CP11A notice because they believe there was a miscalculation on your tax return for the year in question and made changes to reflect this.

IRS notice CP05A is sent by the IRS to inform taxpayers that they need more information about the submitted income tax return before a tax refund can be issued.

You received an IRS CP87A because someone else filed a tax return and claimed the same dependent or qualifying child that you claimed on your tax return.

IRS CP53 and 53A letters are issued because the IRS was unable to issue your refund by direct deposit. There are several reasons why this may occur.

IRS notice CP523 informs you the IRS intends to terminate your installment agreement or payment plan because they haven't received one or more monthly payments.

If you’ve received an IRS deficiency or IRS determination and disagree with the changes, how can you dispute them? Read on because we’re here to help!

The IRS assessment period is at least six years if enough income was omitted. If the the omission of income was deliberate, the IRS has all the time they want.

IRS Notice CP21A is a letter that the IRS issues when changes have been made to a tax return by the taxpayer, usually after they have filed an amended return.

A CP518 notice is issued by the IRS to taxpayers because they have no record of a tax return being filed for the year listed on the notice.

If you received an IRS notice CP521, it is because you entered into an installment agreement with the IRS for taxes owed and your monthly payment is now due.

An IRS Notice CP45 is a letter the IRS sends to notify you that your request to apply your overpayment to your next year’s estimated taxes cannot be granted.

IRS Letter 105C notifies you that the IRS did not allow the credit or refund you claimed. Usually, Letter 105C will explain why your claim was disallowed.

IRS Notice CP10 is issued when the IRS believes there was a miscalculation on your tax return. This results in changes that affect your estimated tax payments.

An IRS CP16 typically informs you that the IRS believes a miscalculation or other error was made on your return, and they have adjusted your refund.

A CP75D is issued when the IRS needs you to verify your income and/or withholding. This could affect whether you receive a refund or owe the IRS additional tax.

IRS letter CP91 states that the IRS may seize up to 15% of your Social Security because you have an unpaid tax balance due. What can you do if you get a CP91?

IRS Notice CP25 informs you that there was a difference between the estimated tax payments you reported and the amount that the IRS posted to your account.

An IRS Notice CP32A is informing you that your refund check has not been claimed. To resolve this notice, you must call to request a new refund check.

IRS Notice CP21C is sent out when a taxpayer requests to make a change to their tax return. The notice informs the taxpayer that the change has been completed.

IRS CP06A notice asks you to verify the Premium Tax Credit you claimed on your tax return with documentation. How should you properly respond to this notice?

Notice CP14H is issued by the IRS to inform you of your unpaid shared responsibility payment that is due and to request that payment. How should you respond?

IRS Notice CP21E informs taxpayers that an audit was recently done on their tax return and the IRS determined that those changes resulted in additional tax due.

You just received an IRS Notice CP90 - Intent to Levy and Unpaid Taxes - in the mail. Don't panic. Let's walk through the letter and determine your next steps.

IRS CP22E notice is the result of a recently completed audit. Because of the changes made to your tax return during the examination, you now have a balance due.

One of the most common notices we see at TaxAudit is the IRS Letter 3219C – also called a Notice of Deficiency. What is this notice? Why did you receive it?

Thirty days from the date of the IRS Notice CP90, the IRS has the right to begin taking assets. This can include bank accounts, wages, and retirement accounts.

IRS CP80 notice explains you have a credit on your account for the tax year in question but have not filed a return. The credit will apply to any amount due.

IRS Notice CP60 informs taxpayers a payment was posted to their account in error. The IRS removed the payment and the taxpayer now owes additional tax.

The IRS is required to send out these notices to any taxpayer who has filed a return and has a balance due that has not been paid.

An IRS Notice CP49 is a letter from the IRS informing you that they used all or part of your tax refund to pay a past-due tax debt that you have.

An IRS CP501 is an official notice from the IRS Collections Unit that is sent to taxpayers to inform them that they have an outstanding debt.

IRS letter 4800C is typically asking for verification of items you claimed on your tax return, such as credits, wages, and withholding.

A CP30 notice is sent to inform you that your anticipated refund has been reduced. The IRS will outline why your refund was reduced and list the new amount.

IRS CP23 letter notifies you of a change to your return due to a difference between the amount of estimated tax payments and the amount posted to your account.

The IRS sends out a CP14 notice to notify a taxpayer when they have unpaid taxes and/or penalties and interest. What should you do if you get a CP14?

The IRS CP22A notice is letting you know that changes were made to your filed tax return, and because of this, there is now a balance owed.

Tax audits can be stressful, but they can yield valuable results such as unexpected refunds, beneficial education, and the peace of mind of being compliant.

The IRS is billed you $4,000 due to a $8,000 capital gain or dividend. You don’t know what the $8,000 is from and believe if inherited it should be tax free.

IRS letter CP13 states a miscalculation was made on your tax return and that you do not owe any additional tax, but you will no longer be receiving a refund.

CP11 explains that the IRS has made changes to your return in order to correct a miscalculation made while filing your taxes and additional taxes are due.

The IRS sends letter 4464C to inform you they have chosen to verify your return accuracy. It's sent after a return has been filed but before a refund is issued.

Not all IRS letters are bad news, and the CP09 is one of them. The IRS noticed you did not claim the Earned Income Credit and believe you might qualify for it.

A large tax refund alone will not necessarily generate a tax audit, but if the reason why you received a large refund is questionable the IRS may peek closely.

Taxpayers receive an IRS CP503 because they have an unpaid tax debt. This is the 2nd notice the IRS sends taxpayers that they have an outstanding balance due.

The IRS likely sent you a CP14 prematurely. The IRS may have received your payment, but it hasn't been fully processed due to the IRS enormous backlog of work.

Now that you have received a notice from the IRS, you want to know if you are still going to get your tax refund. The answer is – maybe. Ler's explore more.

What can cause a tax audit? Let’s talk about some of the primary triggers that may cause you to receive an audit or other notice.

Do we actually know what a tax audit is, why they exist, and what we can do to prepare for one? Let's explore the answer to these tax audit questions.

If you review the CP12 notice and do not believe it is correct, it is vital to contact the IRS within 60 days of the date on the notice to request an abatement.

A tax audit is a formal examination of an income tax return. The IRS conducts tax audits to ensure the information on a tax return and amount paid is correct.

The IRS will always notify you by mail if your tax return is selected for audit. The IRS will not initiate an audit by a phone call, email, or text message.

"Winning a tax audit,” simply means that you’ve paid the IRS no more than you rightfully owe. This is where the professionals at TaxAudit come in to help!

If you have ever gone through an audit with the IRS or are just curious why the IRS audits tax returns in to begin with – you are in the right place.

The gap between what taxpayers owe versus what they actually pay looms large. IRS audits are an attempt to collect the funds required to close this gap.

State agencies who collect income tax can audit your tax return. One of the most common reasons for a state audit is the audit of your federal tax return.

You received an IRS notice CP162 in the mail. You are probably wondering why you received this notice and what it means – we are here to answer your questions.

If you’ve been lucky enough to never receive a love letter from the IRS, you’ve probably wondered: What is it like to go through a tax audit?

The IRS sends out lots of different types of letters to taxpayers and one such letter is the CP21B. If you have received a CP21B letter, what do you need to do?

Whether an amount paid for taxes as the result of an IRS or state tax audit is deductible depends on the type of taxes involved. Let's explore more…

You received an IRS Notice CP12 because the IRS corrected one or more mistakes they believe were made on your tax return. What do you need to do?

Now that you have your Letter 6475, what should you do with it? The letter will inform you of the amount that the IRS paid to you for the third EIP payment.

One of the best ways to check the status of your refund is on the IRS website. Your tax professional may also be able to give you a timeframe for your refund.

Generally, the IRS can take up to 3 years from the date you filed to review your return. In certain situations the statute of limitations can be extended.

Yes, TurboTax Audit Defense It is absolutely worth it. Those who have audit defense do not have to panic or make frantic calls upon receipt of IRS tax notices.

The most important thing about having audit defense, in my opinion, is peace of mind. Your tax professional will help you navigate the waters of a tax audit.

The first thing to do when you get audited by the IRS is to not panic! It be scary but with the right tools and resources you will be able to get through it.

Absolutely! Now’s let’s chat about how and why audit defense works. Any taxpayer may be subject to receiving an audit or notice in the mail.

Recently, the IRS sent many taxpayers a confusing set of letters. The follow-up notice, Letter 6470, notifies the taxpayer of their legal rights to appeal.

Rest assured the IRS has no advance knowledge that you have elected to have representation in the case of an audit through Audit Defense.

You might be questioning if TurboTax Audit Defense is any good as you file your tax return through TurboTax. Yes, you want audit defense and it is worth it!

Audit Defense means you will have professional representation in the case of receiving an audit notice from the IRS or any state income taxing agency.

With over 1,700 years of combined Tax Professional experience, TaxAudit's Tax Pros have expert knowledge when dealing with the IRS and State tax agencies.

The terms ‘audit support’ and ‘audit defense’ may sound like the same thing for the average taxpayer. But in the world of taxes, they can be very different.

I could not have been more pleased with TaxAudit services. I highly recommend this service for anyone who does their own taxes.

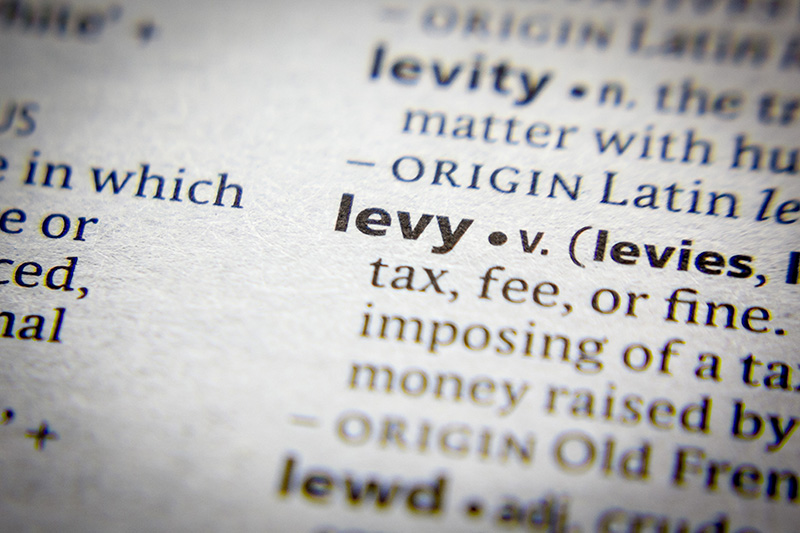

There are hundreds of different types of letters and notices you can receive from the IRS. Let's focus on a few of the more common IRS notice types we see.

Put simply, your audit defense membership is valid as long as your tax return is eligible to be selected for audit or review by the IRS or State!

Well, the truth of the matter is that an attorney is not always needed but, in some cases, one is absolutely required. So, how do you know when that might be?

When you filed your tax returns through TurboTax, you decided to opt in and purchase Audit Defense. If you get a future IRS letter, how does Audit Defense work?

Your audit defense membership with TaxAudit provides expert representation for each tax return year for which you have a membership.

Why doesn't my IRS account show I owe money if I received a Notice of Deficiency? A Notice of Deficiency represents an estimated amount due and isn't finalized.

Yes, you can purchase audit defense a la carte on TaxAudit's website (www.taxaudit.com). TaxAudit is the leading audit defense company in the nation.

When you purchase Audit Defense from TaxAudit, you’re purchasing more than just assistance with your IRS or state notice. You are choosing peace of mind.

There are several federal and state agencies that may have an interest in questioning a business’ operations, income, and expenses after it is closed.

Most CP05 letters will not require immediate action on your part. Generally, the IRS does their review within the timeframe noted, and the refund is released.

Avoid the temptation to ignore the notice. In most cases, the IRS or a state agency may only need additional information to finish processing your return.

The length of an audit depends heavily on the issues being addressed, the level of documentation required, and the Examination Division doing the audit.

First and foremost, audit defense works by protecting you from the hazards and stress of facing off against the IRS (or a state tax agency) on your own.

The first step in preparing for that audit is reading the letter carefully. Audits rarely examine everything on the return, but only ask about specific items.

Audit defense gets you access to a dedicated tax professional who will develop a strategy and handle all communications with the IRS or state agency.

If you received a CP2000 notice from the IRS, it helps to understand what it is and how to handle it. Here are a few essential things to know about a CP2000.

Audits happen for many reasons, and while you may think a disgruntled neighbor ratted you out, the reality is most IRS audits are initiated for other reasons.

The CP2501 notice is just one way IRS asks you about the income you reported on your return and where they feel you may have omitted something.

Whether it’s an audit or a notice, receiving a letter in the mail from the IRS is most taxpayers’ worst nightmare. What can you do that will lower your risk?

A tax professional spends four to ten or more hours per audit - think of the time and stress you could save yourself if you purchase pre-paid audit defense.

Full Audit Representation through an Audit Defense Membership, is included at no additional cost. Other tax experts charge roughly $150/hour for representation.

With Full Audit Representation, also known as Audit Defense, a Tax Professional will defend your tax return through the entire audit process if you are audited.

Generally, amending an already filed tax return will not extend the time the IRS has to audit the return, which is normally three years.

The IRS generally has three years from the date the returns were filed to audit. However, in certain circumstances a return can be audited within six years.

On the IRS’s website is a list of Audit Technique Guides (or ATGs) that IRS examiners use as a roadmap when auditing various types of income tax returns.

Millions of individuals and business owners in America currently have unpaid IRS tax liabilities. Here are a few items to consider for tax debt relief options.

The fact is that there is no standard answer to how long it will take for the IRS to finish up your audit and tell you what, if anything, you owe.

Responding to an IRS audit is not the easiest thing to do. Surviving an audit is much easier with professional representation.

Besides official IRS examinations, the IRS also conducts other types of tax reviews that are not classified as official audits, and these are far more common.

A Notice of Deficiency (aka Statutory Notice of Deficiency, Stat Notice, 90-day letter) is the last letter the IRS sends before making its assessment of tax due

Returns are being processed, and refunds are being issued. Things seem back to normal.

So, what happens if you miss an Installment Agreement payment and/or can no longer make the agreed upon payments?

Of all the types of Installment Agreement requests, Streamlined Installment Agreements are the most varied and provide a bit of flexibility for the taxpayer.

When more than one person wants to claim a child on their tax return, sorting it out becomes complicated. Not only are there five tests to meet for a child...

Lottery earnings are generally reported on Form W-2G, taxed as ordinary income, and expected to be reported as “other income” on the federal tax return.

"Unreal audits" often require the same verification principles as traditional audits and incite the same level of discomfort as a real examination.

This blog post discusses the rules and fees regarding Guaranteed Installment Agreements for taxpayers whose tax debt is $10,000 or less.

Sometimes it only takes six little letters to strike fear in the bravest of taxpayers: IRS IOU (technically, it's not an IOU, but rather a bill).

The IRS is currently offering this cash payment alternative at participating 7-Eleven stores in 34 states.

We have created a list of 5 quick tips on how to deal with any IRS letter you receive to help make the process as quick and painless as possible.

The latest news from the IRS regarding the amounts taxpayers are allowed to spend on necessary living expenses when owing the IRS is not for the faint of heart.

The TAS is an independent organization within the IRS, created with the intention of identifying and resolving problem areas within the tax system.

The correspondence at the focus of my holiday lament is IRS Letter 4464C, otherwise known as the Questionable Refund 3rd Party Notification.

The letter you hoped would never come arrived. You open it and discover the IRS has graciously sent you an invitation to their work mileage deduction review.

What do “Scarface” Capone and a tax audit have to do with each other? Scarface went to prison for - of all things - tax evasion!

I got a CP2000 notice from the IRS. It says I owe $12,269 for securities I sold. I purchased the stock in 2005 and sold it at a loss of almost $10,000...

I received a 1095-A form for health insurance after I had already filed my taxes.

If you get audited, do they send a letter or do they call you?

The overall percentage of individual tax returns examined in 2013, published by IRS, is about 1%; however, this number only takes into account “examinations”

You may have heard that if you are self-employed, or you are expected to entertain clients as part of your job, you can deduct the costs of those meals...

Here are some simple tips to help you reduce your audit risk: Proofread your tax return A mistake on just one figure or item can present IRS audit flags…

When your tax return is audited, the IRS will ask to see records and documents that show how you came up with the dollar amounts reported on your tax return.