TaxAudit Blog: Small Business

Learn what Form 1099-NEC is, who must file it, and how the One Big Beautiful Bill impacts reporting thresholds for non-employee compensation starting in 2026.

What happens if an employer withholds federal income, Social Security, and Medicare taxes on behalf of the employee but does not give the taxes to the IRS?

Per diem payments for contractors can either be taxable or non-taxable, depending on whether they fall under accountable or non-accountable plans.

Self-employed taxpayers can claim per diem deductions for business travel, provided that the circumstances of their travel meet certain conditions.

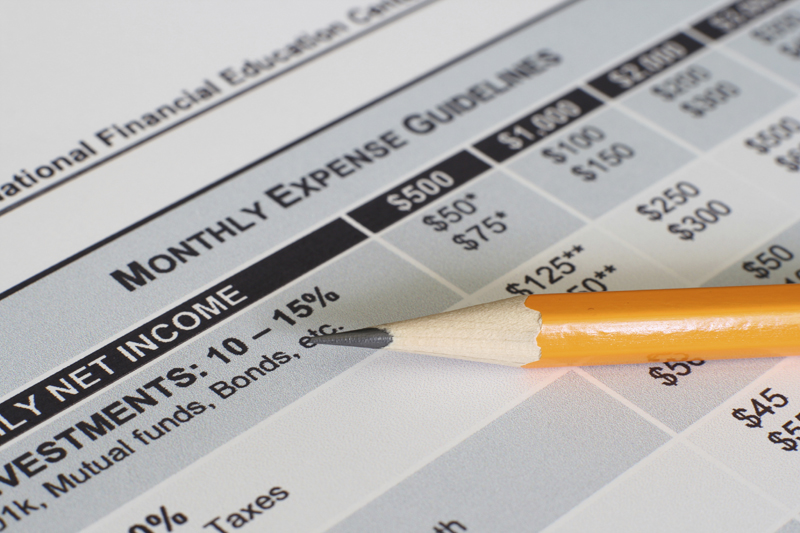

What does the balance sheet represent in your tax return? A balance sheet is a financial statement that reports a company's assets, liabilities, and equity.

The IRS may determine your business is a hobby, limiting what you can deduct as expenses. This is particularly true if the activity consistently loses money.

Yes, car insurance can be tax deductible for self-employed taxpayers, Armed Forces reservists, qualified performing artists, and some government officials.

What is beneficial ownership information reporting? If you aren’t certain whether it applies to you, this blog may help clarify the reporting requirement.

Yes, you may be able to deduct mileage and gas on your taxes, but only if you meet certain conditions. Please allow me to explain.

Utah does not require quarterly estimated tax payments by taxpayers who file a Utah tax return. However, taxpayers can make a prepayment at any time.

Taxpayers who file a Kentucky tax return and expect to owe more than $500 (after any taxes withheld and allowable credits) must make estimated tax payments.

Louisiana taxpayers who expect to owe $1,000 for single ($2,000 for joint) or more, must make a declaration of estimated income and pay estimated tax payments.

Regardless of whether they are a Michigan resident, taxpayers who expect to owe more than $500 when they file their MI-1040, must make estimated tax payments.

Yes, Tax Debt Relief is available for businesses. Read more about tax debt issues businesses face such as Employment Tax Issues, Trust Fund Taxes, etc.

If you estimate that you will owe more than $400 in New Jersey income tax at the end of the year, you are required to make estimated payments.

Groceries you buy for your household are a personal expense and are not deductible. But there are numerous cases in which food can be deductible.

If you happen to miss one of your quarterly estimated tax payments, all is not lost. As soon as you remember, go ahead and make the quarterly payment late.

A number of different software applications that use a smartphone have become available for the purpose of recording business and personal mileage.

You can deduct an unpaid invoice as a business expense if all the following are true: (1) You have already included the amount of the invoice as income…

If you want to deduct your first-class airfares, be aware that the IRS may question you about these expenses and will make its decision based on each trip.

The deduction of any expenses, including snacks for riders from rideshare drivers, depends on your personal facts and circumstances. Let's explore more.

Tax law does allow business owners to use the gifts they made to clients to increase their deductions from taxable income, but there is a dollar amount limit.

As a rideshare driver you can likely deduct your carwash expenses on your taxes. But, as always, certain conditions have to be met. Allow me to explain.

Are there situations where travel expenses are tax deductible? Yes. In this blog, we will discuss five situations where travel expenses are deductible.

The IRS regards your personal driver’s license as a nondeductible expense. A commercial driver’s license that is required for your business may be deductible.

The good news is there are many different expenses that you may be able to deduct in relation to your dog-walking job – but your shoes may not be among them.

If you are self-employed, you may be able to deduct your home office internet expenses on your taxes. Let's review the guidelines for an internet deduction.

Many taxpayers use a written logbook that they keep in their vehicle or a software application on their smartphone to track their deductable miles.

Writing off the purchase of solar panels for your sole proprietorship can be complicated, but we will try to highlight some of the options for you to consider.

Falling behind on your California payroll tax payments effects not only your employees, but also on your business operations as the EDD imposes penalties.

Employees cannot deduct dry-cleaning costs on federal taxes until 2026, but self-employed individuals can take the deduction by meeting 3 qualifying tests.

Fortunately, the short answer to the original question is yes, Illinois state payroll tax debt can quite possibly be reduced.

The IRS has the power to impose some very strong penalties for businesses that fall behind in their obligations to make the scheduled payroll tax deposits.

Yes, you can deduct your business meals – but there are conditions that must be met. Under normal circumstances, qualifying business meals are 50% deductible.

Are attorney’s fees deductible on my tax return? The answer, like a lot of answers to tax questions is: Sometimes yes, sometimes no. Let's explore more.

Accountant fees for a business purpose are generally deductible, but when those fees are incurred for a personal purpose, they are currently not deductible.

The qualified business income deduction is calculated by taking the income and losses from all your business activities and netting them into one amount.

The IRS treats payroll tax debt seriously. Any employer or employee whose job it is to collect and pay the taxes, but willfully fails, can be held responsible.

For most taxpayers bank fees are not deductible. However, taxpayers who operate their own business may be able to deduct bank fees.

Yes, you can deduct interest on your business and personal credit cards to the extent that the interest relates to business expenses. Let's explore more.

Yes, you can deduct a portion of your home rent for your home office on taxes – but as always , this benefit is only available if certain conditions are met.

The good news for other farmers is that, under certain conditions, the tax code allows for the deduction of farm expenses even if they are greater than income.

The IRS takes payroll tax debts very seriously and has the power to impose some very strong penalties for businesses who fall behind in this area.

Two payroll tax deferral programs were launched in 2020 in an attempt to relieve the cash flow squeeze that was affecting both businesses and their employees.

If you suffered economic losses, you may have a net operating loss (NOL) on your taxes. Getting audited by the IRS for an NOL can be complicated.

For many taxpayers who operate small businesses, the qualified business income deduction can be an excellent way to reduce your income taxes.

There are many options for managing your small business tax debt. A tax resolution specialist from TaxAudit can guide you in choosing the best approach.

Trade or business property is considered section 1231 property. For taxation purposes, section 1245 or 1250 applies depending on the property’s characteristics.

If you find yourself with tax debt due to unpaid payroll taxes, you may have options to help settle the debt. Let’s review some payroll tax debt relief options.

If you are a small business owner, you may have heard about net operating losses. If you have one, it may create a reduction in your taxes in other years.

As taxpayers, we are personally responsible for filing our returns both on time and accurately. Failure to do one or both can result in significant penalties.

If you operate a business from inside your home, the home office deduction can be one of the largest deductions you can take as a tax write-off.

My wife drives to transport our granddaughter to our house to watch for the day. Is this to-and-from mileage deductible as a job-related expense?

When you prepare your federal income tax return, your business may incur a loss. Here are the tax implications if you have suffered a net operating loss.

As a self-employed taxpayer, you can deduct your business-related parking fees as an expense on Schedule C, Profit and Loss from Business.

The IRS takes payroll tax delinquency seriously – so seriously that IRS Revenue Officers have closed down businesses for not paying them. Tax help is available.

There are several federal and state agencies that may have an interest in questioning a business’ operations, income, and expenses after it is closed.

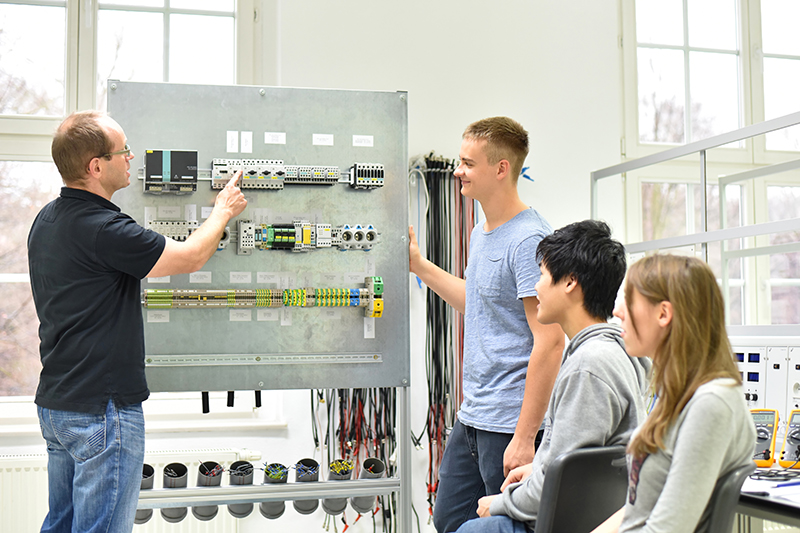

Depending on the nature of the education, there may be an avenue to account for work related education expenses on one's tax return.

There is a very good chance that you can indeed deduct the cost of your oil changes if you use your car or truck for business purposes. Let's look closer at it.

Generally, a “regular” limited partnership does not throw off any income that would make it currently taxable while it is inside an IRA.

When operating a business, the last thing you want to worry about is being audited by the IRS or a state agency. Record keeping should be a high of a priority.

If you are the sole proprietor, the chance of being selected for audit by the IRS is 4.5 to 12 times higher than it is individuals without a business.

If you have unreimbursed business expenses as an employee, then those expenses are generally no longer deductible on your 2019 federal tax return.

Just like there are hundreds of poses in yoga, the tax law is not so simple - and there are subtle variations that determine whether the answer is yes or no.

Yes, under certain conditions, health insurance premiums are tax-deductible. Generally, the health insurance premiums can be deducted in one of two ways.

On the IRS’s website is a list of Audit Technique Guides (or ATGs) that IRS examiners use as a roadmap when auditing various types of income tax returns.

Yes, kids may have to pay taxes. No matter a person's age, if they have income that exceed certain IRS thresholds, the income should be reported.

When it comes to the deductibility of business expenses the answer is likely to be “Yes, No, Maybe So, or Not Now.” Here are a few examples to consider.

As part of the tax reform laws, the home office deduction was eliminated for all tax years from 2018 through to 2025 for taxpayers who are employees.

The fact is that running your own business increases your chances of being audited by the IRS or your state tax agency.

Here is a list of some of the taxpayers who will generally benefit from the new tax law.

Deductions for expenses considered to be entertainment, amusement or recreation have basically been eliminated except for the deductibility of business meals.

The Tax Cuts and Job Act of 2017 introduces some perks for small business owners that you won't want to miss.

The IRS encourages all businesses and business owners to know the rules when it comes to classifying a worker as an employee or an independent contractor.

There are only two months left in the year. What can I do now to avoid paying a big tax liablity on my Schedule C business next year?

Businesses subject to backup withholding can rectify the problem by contacting their payment card processor or third party settlement organization.

We have been asked to build some basic boxes to be used as a stage for a company. They plan to pay us but are not placing us on their payroll as employees.

I live in Georgia but work in the oilfields of Alaska as a Form 1099-MISC contractor. Am I allowed to deduct my airfare and hotel and meal expenses for travel?

If you have a dedicated credit card for your business, can you use the statement as the receipt for your business entertainment, meals, travel, etc.?

You may have heard that if you are self-employed, or you are expected to entertain clients as part of your job, you can deduct the costs of those meals...