TaxAudit Blog: Tax Preparation and Planning

Married but separated? IRS tax filing status options explained, including joint, separate, and Head of Household, plus key credits and deductions.

Learn why tax returns are rejected for e‑filing, what IRS rejection code REJ001 means, and how to fix timing, SSN, and software errors fast.

Learn how to pay your IRS tax bill by credit card, the fees involved, and when it’s a smart option—plus alternatives for affordable tax debt relief.

Learn how the new 2025 No Tax on Tips rule works, who qualifies, income limits, and how tip‑based workers can save more on federal taxes.

Wondering how long to keep tax returns and tax records? Follow IRS record retention rules to stay organized, compliant, and audit-ready.

Learn the correct tax filing status for widows or widowers without dependents, including key IRS rules and financial implications.

Learn why the IRS is ending Direct File under the Big Beautiful Bill Act and what free tax filing options remain for taxpayers.

Learn when the no-tax-on-overtime rule starts, who qualifies, income limits, and how to claim your deduction under the new legislation.

Discover how changes to the SALT deduction can reduce your federal tax bill—especially if you live in a high-tax state or itemize deductions.

Discover tax rules, loopholes, and pitfalls for Airbnb and short-term rentals to reduce liability and maximize deductions legally.

Married couples who are not living together can file their taxes as Married Filing Jointly, Married Filing Separately, or Head of Household filing status.

For the following two years after the year of your spouse’s death, you may be able to file your tax return as a Qualifying Surviving Spouse (QSS).

Most changes to filing status are allowed with an amendment, assuming you meet the requirements of the new filing status. You have 3 years to file an amendment.

The Head of Household filing status applies to taxpayers who are responsible for the care of another who is their dependent. You must pass three tests.

Digital assets received via an airdrop, such as cryptocurrency or NFTs, are taxable to the recipient and includable on their income tax return.

Each stock option has its own characteristics and reporting is not the same. If there is employee withholding, the employer submits to the taxing authority.

What happens if an employer withholds federal income, Social Security, and Medicare taxes on behalf of the employee but does not give the taxes to the IRS?

If you are legally separated by the end of the tax year, you must file as Single unless you qualify to file as Head of Household.

Once your child turns 17 they no longer qualify you for the child tax credit, but many tax benefits can still be claimed with that child as your dependent.

Does Hurricane Milton or Helene qualify as a diaster loss for tax purposes? What are the tax implications of natural disasters taxpayers should be aware of?

The fastest way to check the amount of Montana estimated taxes you already paid is through the Montana Department of Revenue’s (DOR) TransAction Portal (TAP).

Per diem allowances are generally not taxable to employees. However, there are some instances in which a per diem becomes taxable. Let's look at some examples.

You're liable for estimated tax payments if your Connecticut income tax will be $1,000 or more and tax withheld will be less than your required annual payment.

Federal estimated tax voucher #4 list in mail. What actions should I take in filing my tax return? The IRS began accepting 2024 income tax returns on 1/27/25.

My child’s Social Security number was used on another tax return. What do I do? It is prudent to file an IRS identity theft affidavit as soon as possible.

In this article we will discuss some key issues related to whether life insurance is tax deductible and a few potential tax benefits of life insurance.

If you find yourself in need of making estimated payments, I hope this guide is just what you need to tackle paying them in the Commonwealth of Massachusetts.

A nonrefundable tax credit lowers your tax liability but not below zero. Therefore, a nonrefundable tax credit cannot be used to create a tax refund.

Credits can either be refundable or non-refundable. Refundable tax credits can result in a refund if the credit amount is more than the taxes you owe.

Estimated tax payments must be made when the estimated taxes owed by a Montana taxpayer – after any withholding and nonrefundable credits – is more than $500.

Whether a taxpayer files a tax return in any given state is generally based on the source of the income, but their tax home is usually where they are domiciled.

Utah does not require quarterly estimated tax payments by taxpayers who file a Utah tax return. However, taxpayers can make a prepayment at any time.

The short answer is YES. Minors who are employed and earn income are generally subject to federal withholding taxes, just like adult employees.

Because the distributions from a Roth IRA are usually not taxable, contributions you make to them are also not deductible.

Taxpayers who file a Kentucky tax return and expect to owe more than $500 (after any taxes withheld and allowable credits) must make estimated tax payments.

To answer this question, an individual must first determine whether they are considered a resident alien or a nonresident alien for U.S. income tax purposes.

Louisiana taxpayers who expect to owe $1,000 for single ($2,000 for joint) or more, must make a declaration of estimated income and pay estimated tax payments.

Wisconsin taxpayers who expect to owe more than $500 after withheld taxes and allowable credits should make estimated tax payments or increase withholding.

Taxpayers who file a Virginia tax return and expect to owe $150 or more over any taxes already withheld might need to file estimated tax payments.

Regardless of whether they are a Michigan resident, taxpayers who expect to owe more than $500 when they file their MI-1040, must make estimated tax payments.

In Illinois you may not be subject to the penalty if you pay at least 90% of this year's tax or 100% of last year's tax in four equal timely installments.

If you estimate that you will owe more than $400 in New Jersey income tax at the end of the year, you are required to make estimated payments.

Both a tax deduction and a tax credit reduce the amount you may owe on your return, and possibly increase your refund. But how they get there is different.

You received a letter from the State of Colorado stating you do not qualify for a state sales tax refund because your return was filed after the deadline.

Most states that have income taxes offer a credit for taxes paid to another state on the same income, although how that credit is calculated is not identical.

The PA Dept of Revenue expects you to make PA Estimated Tax payments if you make more than $9,500 of taxable income that has not had taxes withheld from it.

In most circumstances, you must file an amended return within 3 years from the date you filed your original return or 2 years from the date you paid the tax.

Creating your IRS online account starts with a simple trip to the IRS website. You will need an email address, a smartphone with a working camera, and an ID.

An amended IRS tax return refund can take in the region of 20 weeks to receive. The Where’s My Amended Return? Tool allows taxpayers to check the status.

The general deadline for an amended tax return is 3 years from when the original return was filed or 2 years from when the tax was paid, whichever is later.

A CP518 notice is issued by the IRS to taxpayers because they have no record of a tax return being filed for the year listed on the notice.

A number of different software applications that use a smartphone have become available for the purpose of recording business and personal mileage.

You can use the US tax code to reduce the impact of foreign taxes you have paid or incurred depending on the country or countries involved.

Much like the IRS, California’s taxing agency, the California Franchise Tax Board (or CA-FTB), expects to collect your owed taxes throughout the tax year.

Similar to the IRS, New York’s taxing agency, the New York State Department of Tax and Finance, expects to collect your owed taxes throughout the tax year.

A child who qualifies as a dependent on their parent’s tax return will need to file a tax return in certain situations. Let's explore when they need to file.

What if you want to claim the Child Tax Credit, but your name is not on the birth certificate? This may be time to consider an IRS approved paternity test.

In 2023 the tax returns are due April 18th for most taxpayers. However, if you live in California, Alabama, or Georgia your taxes may be due at a later date.

If the IRS applies your payment to the wrong tax year, they will generally fix the issue once they know the problem. Let's learn more.

Making sure your tax return is correct, even if that means amending your return, is better than having an incorrect return and hoping the IRS doesn’t notice!

Cryptocurrency is not treated as money for U.S. federal income tax purposes, but rather as property so tax rules that apply to property apply to cryptocurrency.

If the IRS notices that you filed an amended return, will that cause them to inspect your tax return more closely and trigger a full-blown tax audit?

First, the essential concept to understand is that cryptocurrency is not treated as money for U.S. federal income tax purposes but is treated as property.

Yes! Audit Defense is worth it. Not only do audit defense members get help with IRS and state correspondences – there are a variety of other benefits.

If you are one of the millions of taxpayers who use TurboTax to file their taxes, you may have asked: Can I deduct my TurboTax purchase? In short: it depends!

New Jersey, NJ imposes a tax on the beneficiaries of estates. The tax return requires the tax be paid by the estate on behalf of all the estate’s beneficiaries.

My Aunt died and the bank sold her house. The bank sent me a check for "excess proceeds" from the house sale. Do I owe any tax on this money?

As taxpayers, we are personally responsible for filing our returns both on time and accurately. Failure to do one or both can result in significant penalties.

The fastest answer is how far back do you need to file? How deep do you want or need to dig into your records to get your taxes up-to-date with the IRS?

You are ready to begin the process of preparing your back taxes – but you realize your records are lost. Never fear. There are ways to rebuild your records.

If you are under audit, it is acceptable to submit your current tax return. Just be mindful that you may have to amend it once the previous year's audit closes.

An incarcerated person can actually e-file for themselves online if they have internet access in prison. If they are unable to do so, you can do it for them.

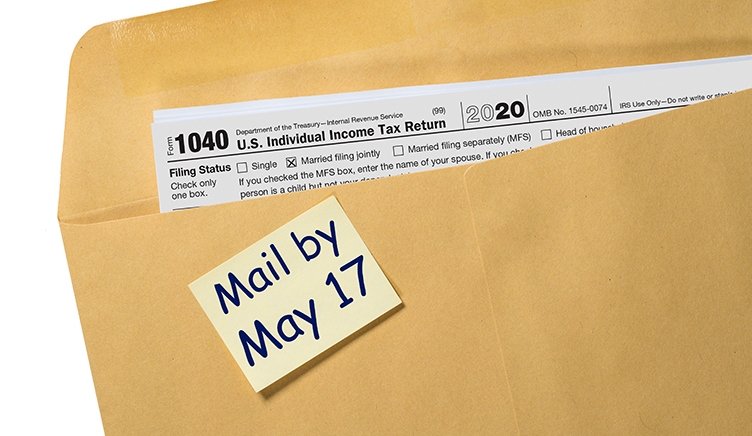

The IRS encourages electronic filing to avoid processing delays. However, you may mail your IRS and state returns in. You can find the address required here.

What should I do if I receive a notice for overpayment from work benefits with the workforce commission, and I have already filed my taxes?

If I haven't worked in a couple of years and didn't file taxes or get the first stimulus check, then where do I start or how do I file?

When people ask me for advice on how they should deal with filing unfiled tax returns, I usually tell them to file the most recent year first.

If you choose to mail in your tax payment to the IRS or state, I recommend mailing it via certified return receipt or priority mail so that you can track it.

With the July 15th tax deadline approaching, here’s what you need to know. (1) If You Need More Time, You Can Still File for an Extension (2) Pay What You Owe

While there are several ways to save on your tax bill, one of the easiest ways is to put money away for retirement.

On the IRS’s website is a list of Audit Technique Guides (or ATGs) that IRS examiners use as a roadmap when auditing various types of income tax returns.

You can call the IRS to see if your refund has been flagged for garnishment. Then you can reach out to set up a payment plan − if warranted.

Yes, kids may have to pay taxes. No matter a person's age, if they have income that exceed certain IRS thresholds, the income should be reported.

Audit defense is a service offered through TaxAudit to support our members in the event that their state or federal tax return is selected for review or audit.

The IRS declared that any cryptocurrency with an equivalent cash value is to be treated as property for tax purposes, and transactions are therefore taxable.

Most taxpayers are familiar with the terms standard deduction and itemized deductions, but many are unaware of the differences between the two.

If you need to amend your federal tax return, this is done on Form 1040X. Here are some dos and don'ts when filing an amended tax return.

Inmates are responsible for filing taxes. While you can certainly help your boyfriend file his taxes, you can’t sign and submit the return on his behalf.

Choosing the right tax preparer is serious. Picking the wrong tax professional may have a severe impact on the health of your finances. So choose wisely!

Not all taxpayers are required to file a federal income tax return. Determining if you have a filing requirement starts by evaluating your gross income.

While increasing allowances leaves you with more available funds throughout the year, it will have a rippling effect and your tax refund will decrease.

If you are facing an unexpected tax bill, here are some things to keep in mind. The IRS offers multiple payment options.

Taking these few steps today will save you time and hassle come time to file your 2018 tax returns in 2019.

When it comes to taxes, there is no shortage of situations to prepare for. One of the most overlooked areas relates to natural disasters.

So, what happens if you miss an Installment Agreement payment and/or can no longer make the agreed upon payments?

Taxpayers who filed for an extension to file their 2017 tax returns should keep in mind that the extension deadline is October 15th, 2018.

Of all the types of Installment Agreement requests, Streamlined Installment Agreements are the most varied and provide a bit of flexibility for the taxpayer.

When more than one person wants to claim a child on their tax return, sorting it out becomes complicated. Not only are there five tests to meet for a child...

Lottery earnings are generally reported on Form W-2G, taxed as ordinary income, and expected to be reported as “other income” on the federal tax return.

This may seem like a strange question, but with over 1.1 billion dollars of unclaimed money at stake, it's a question worth asking.

This blog post discusses the rules and fees regarding Guaranteed Installment Agreements for taxpayers whose tax debt is $10,000 or less.

The IRS offers a number of resources to help you make sense of your withholding requirements, including YouTube videos and an online withholding calculator.

With the increasing popularity of ridesharing services such as Lyft and Uber, you may be asking yourself, “Can I make extra money doing this?”

The IRS general rules for keeping tax records and returns is you must keep them for the period of time in which the IRS can audit you and assess additional tax.

Your company offers you employee stock options. The paperwork says they are Nonqualified Stock Options (NQSO’s). You don’t quite understand what that means...

One of the most frequent scams we see during tax season is that of the crooked tax preparer.

There are some tax benefits available to our military personnel. These adjustments are designed to give back to the men and women who have given so much for us!

The IRS has some quick and helpful tips for those who are anxious to get their yearly tax filing out of the way.

The IRS is currently offering this cash payment alternative at participating 7-Eleven stores in 34 states.

The IRS recently announced that their "Get Transcript Online" feature is now available for taxpayers who would like to obtain their tax transcripts.

There are a few things you should know about gambling and how it can affect you when tax time rolls around.

You have three extra days this year to file, as 2015 federal tax returns are not due until April 18th (or April 19th for residents of Maine or Massachusetts).

January is right around the corner, so let’s make a tax list - and check it twice - for last minute tax saving opportunities!

This is a brief summary of the IRS's numerous requirements in regard to charitable giving.

Here are 3 tips to help make the upcoming tax filing season just a little bit easier.

There are only two months left in the year. What can I do now to avoid paying a big tax liablity on my Schedule C business next year?

The letter you hoped would never come arrived. You open it and discover the IRS has graciously sent you an invitation to their work mileage deduction review.

If you are getting married, keep these tax items in mind as part of your wedding checklist.

You remember you hit the snooze button on preparing your 2014 return in April and decided to file an extension, instead.

I would really appreciate some advice on filing estimated taxes. Please let me know if you provide this service.

The IRS has taken the initiative to remind taxpayers about the importance of protecting and preserving important documents, should disaster choose to strike.

What is the best option are for getting rid of an old vehicle? Should I donate it for the auto valuation guide value of $3,000 or sell it now for $1,500?

You may not be feeling the groove just yet. It’s been a long winter, and you are hoping that maybe the deep freeze caused the IRS to forget about you this year.

My boyfriend and I have been living together for nine years. Can we file a joint tax return this year?

How long does it take to get my refund if I e-filed my taxes? It seems like I should have received it by now.

My wife and I are preparing our taxes, and, due to her employment situation(s) and our investments, we have received a number of 1099s...

When your electronically filed tax return is rejected by the IRS, it can be frustrating. But, most of the time, there’s a simple explanation for the rejection.

How many miles can I claim on my tax return when driving for work?

Are you short on cash and don’t have the money to pay your tax bill? The IRS does have a few options for the taxpayer who is cash short at tax time.

filed my tax return, and then a W-2 came in the mail for a job I worked earlier this year that I had forgotten about. How do I file this?

Are you gathering all your necessary tax documentation now?

There is some misconception in the words “head of household.” Yes, in the ordinary sense of the term you may be head of household, but when it comes to taxes...

The holidays have come and gone, footballs are filling the air as bowl games and playoffs are well underway, and it’s time to start thinking about…taxes?

The holiday season is a time for giving, but if you don’t follow the carefully prescribed rules for charitable giving, the IRS may disallow your deduction.

If at this late date you still haven’t filed your tax return, here are some tips to help you avoid many of the most common tax return errors.

Casualty losses can happen to taxpayers, such as a fire caused by a faulty heater. Do you have copies of your important documents in a safe place?

When it comes to proving deductions taken on a tax return, the burden of proof is on the taxpayer, according to the Internal Revenue Code (IRC).

If you made an mistake on your taxes or omitted required information, such as a late-received W-2 or K-1, you can file an amended return on Form 1040X.

It’s still not too late to make adjustments to your withholding or estimates to make sure your 2014 taxes will be done correctly and you will not be surprised..

We have been asked to build some basic boxes to be used as a stage for a company. They plan to pay us but are not placing us on their payroll as employees.

If you like to gamble, you probably already know that your gambling winnings are considered income, especially if you gamble within the United States.

Years ago, I was just like most people when it came to taxes. Just the thought of doing my tax return gave me hives. I had been burned twice at tax time...

1. Taxes Might Be Your Biggest Expenditure 2. Many Major Life Decisions Have Tax Consequences 3. Knowing About the Latest Tax Breaks Could Save Money 4. Taxes..

Yes, Uncle Sam loves lawsuit settlements just like plaintiffs do. Before you start spending the money, there are some things you need to know.

I bet you all do not want to even see the word TAX right now! I know what you are doing. Lying in your hammock or lounging by the pool drinking a lemonade.

The IRS generally won’t look for you unless you owe them money. If you don’t file for a refund within 3 years of the original due date of the return...

If you have a dedicated credit card for your business, can you use the statement as the receipt for your business entertainment, meals, travel, etc.?

Tax returns are due on June 16th for U.S. taxpayers living abroad who qualify for and are taking advantage of the automatic two-month extension.

First job ever? What do you do about those pesky tax forms they gave you at the job? How do you fill them out? Why are they taking all that money out!?

There could be a number of reasons for a delayed refund. The IRS may be eliminating the possibility of identity theft, or it is possible a tax audit is pending.

You got your return filed on time and you’ve got a nice big refund coming. But the funds don’t show up in your bank account when you expected them to. Now what?

You owe money to the IRS – now what? Don’t faint, don’t freak out, and don’t worry! There are simple ways to take care of that balance due.

The April 15th deadline is approaching. Taxpayers are most likely to make errors on returns when they are rushing to finish their returns before the deadline.

If you are upset about the national debt, you can make a deductible charitable contribution to the Bureau of the Public Debt to help out.

Filing for a tax return extension does NOT give you an extension of time to pay your tax bill.

A refund is NOT a bonus and a balance due is NOT a penalty. When you began working, you filled out a W-4 stating how many exemptions you wanted.

The fastest way to get your money without paying additional fees is to e-file your return and have the money Direct Deposited to your bank account.

As for an individual with a business, it is beneficial to research what is on the market in regards to business accounting software. There are numerous...

The IRS just announced a new version of their mobile app, IRS2Go. You can use the app to track your refund status and more.

You cleaned out your closets, attic and garage this year and took all of those piles down to your local charity drop-off location. (I bet that felt good.)

It’s that time of year when taxpayers begin to get massive headaches. If you feel your head pounding, following these simple tips could save you more pain.

Have you ever thought about New Year’s Tax Resolutions? What can I do better when it comes to my personal and business taxes?

If you are a U.S. citizen living and working overseas, the IRS expects you to report the money you earn just as if you were residing on U.S. soil.