You got a CP22A | What should you do?

February 27, 2023 by Kate Ferreira

After rifling through all the ads and catalogs in your mailbox, you spot something that sticks out like a sore thumb – a notice from the IRS. You rip open the letter and see that you have received an IRS Notice CP22A. This notice is letting you know that changes were made to your filed tax return, and because of this, there is now a balance owed. Many thoughts swirl around your brain, but the two questions you want answers to are: 1) why did I receive this notice and 2) what should I do? These questions are likely how you found yourself on this page, and you are in the right place – so read on!

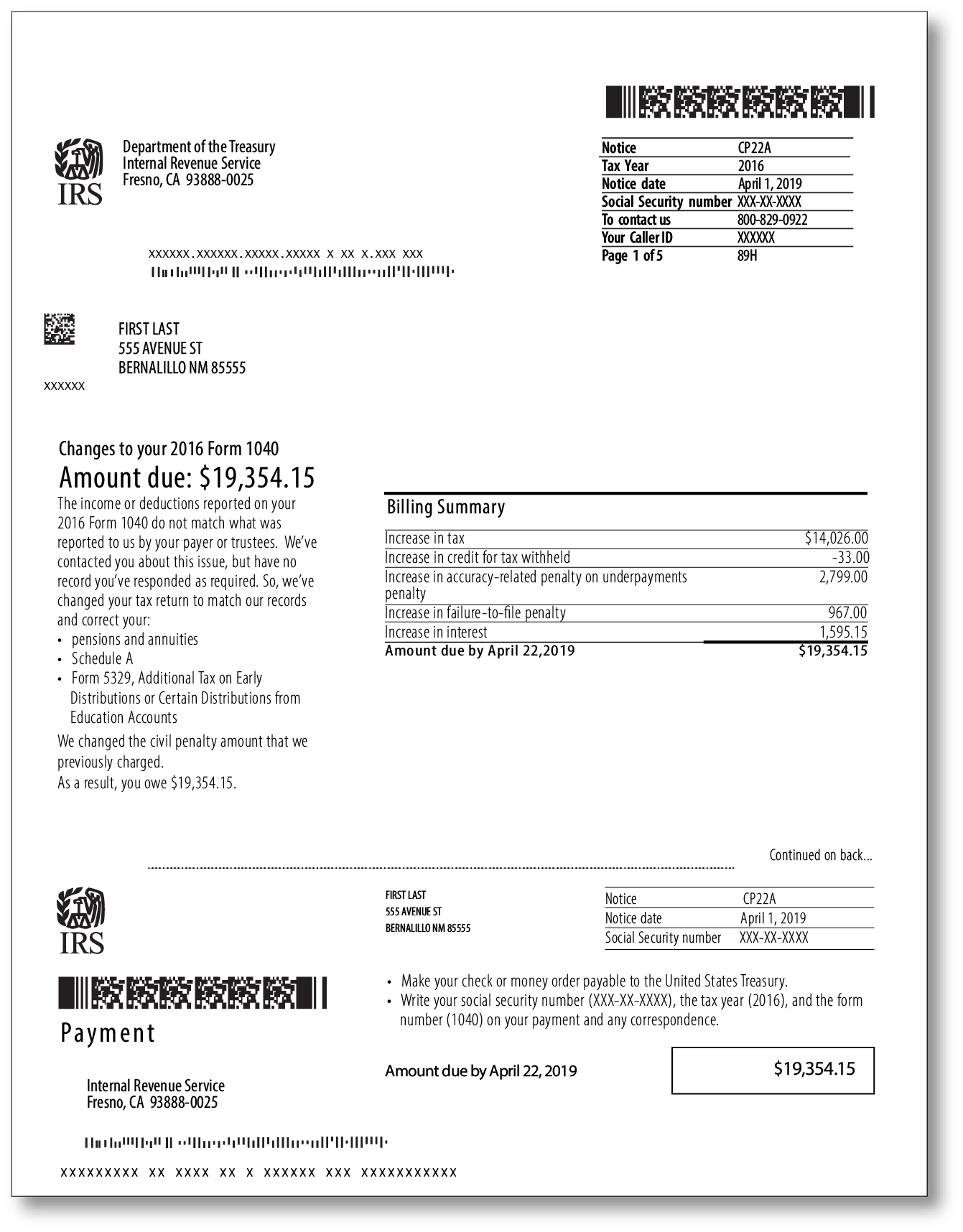

What does an IRS Notice CP22A look like?

If you are curious if you received an IRS Notice CP22A, below is an example of what one looks like:

So, why did you receive an IRS Notice CP22A? There could be one of two reasons!

- The income or deductions that were reported on your tax return do not match what was reported to the IRS. The IRS attempted to reach you regarding these changes but did not get a response from you, so they issued this notice with the proposed changes; OR

- You discovered that you had made an error on your tax return after filing and either contacted the IRS to notify them of these changes or filed an amended return. The IRS issued this notice to make you aware of a balance owed after the requested changes were made.

- If you don’t remember sending any changes to the IRS, call the phone number listed in the top-right corner of the notice to speak to an IRS agent and get more information.

What should I do now that I received an IRS Notice CP22A?

The first thing you want to do after receiving your IRS letter is read the notice in its entirety. The notice should explain the amount you owe and why the IRS is proposing these changes.

If you agree with the changes, the IRS advises that you correct the copy of your tax return in your records for future reference. Additionally, make sure to pay the balance in full by the due date; the notice typically provides 21 days for a response. If you are unable to pay the balance in full, make arrangements to set up a payment plan.

If you do not agree with the changes proposed by the IRS, or the amount proposed, a response will need to be sent to the IRS. This is where we come in! If you have an Audit Defense Membership with TaxAudit, this type of notice is something we will help with as part of your membership. Simply contact our Customer Service Department, or click here, to start a case. Our team of expert audit representatives, which includes attorneys, CPAs, and Enrolled Agents, provides tax audit help for thousands of cases each month. If you received a letter similar to this one, or any tax debt – we can help you!