TaxAudit Blog: Home and Rental Property

Get the details on the reinstated mortgage insurance premium deduction, who qualifies, how limits apply, and what homeowners need to know for tax filing.

Discover tax rules, loopholes, and pitfalls for Airbnb and short-term rentals to reduce liability and maximize deductions legally.

Does Hurricane Milton or Helene qualify as a diaster loss for tax purposes? What are the tax implications of natural disasters taxpayers should be aware of?

There is a catch to the allowance for rental losses. The $25,000 limit is reduced by $1 for every $2 your modified adjusted gross income exceeds $100,000.

There is a very good chance you can deduct mortgage interest on a second home – but it depends on the details of your situation. Let's explore more.

Two siblings were listed on the title of a home with their mother. She died and the siblings sold the home and distributed the funds to the other siblings.

How do I write off solar panels for rental properties when I claim as a real state professional to run a rental business?

The deductibility of origination fees on your taxes from buying a new home is dependent upon a few factors - the main factor being if itemize your deductions.

Rentals are considered to be special passive activities and the amount of loss you can use in any year is limited to $25,000, if your AGI is under $100,000.

Can you claim a depreciation deduction for Section 1250 residential property in the year the property is sold? When it comes to taxes, details matter.

Details regarding the disposition of grouping of activities in order to more easily satisfy the material participation requirements for the RE Pro status.

Whether you use your second home for personal or business purposes, the interest you pay on the mortgage may very well be deductible on your tax return.

HOA fees are not deductible for a property used as your private home all year. But there may be a deduction for those who use their home for business purposes.

How does the IRS determine what your primary residence has been to claim the exception or exclusion after selling a house? Let's go over the ownership tests.

Yes, you can indeed receive a tax benefit for installing new energy efficient windows on your house – provided that certain conditions are met.

If you meet the conditions for the home office deduction, you are allowed to deduct a portion of your home insurance premium.

I'm inheriting $44,000 from my father's house being sold in New York. I just want to know how much tax, if any, would I have to pay in South Carolina. Thank You

My brother's wife died and he was left with the house. He gifted (no exchange of money) me the house and I sold it. How do I report capital gains?

Generally, the costs of moving or disposing of items are considered personal expenses and are not deductible, even though removing the items are required.

When considering using retirement funds to help pay for a new home, there are generally two common options taxpayers can consider: A 401(k) plan or an IRA.

Is investing in real property, particularly rental property, a good idea for your retirement investments, especially your traditional IRA or Roth IRA?

My wife will be inheriting her father's home. We intend to sell our home and invest the proceeds to remodel this inherited property. What is the tax process?

Electing to group properties together into one activity to qualify for real estate professional status comes with some disadvantages. Let's explore more.

Your son does not need to report or pay tax on the $70,000 you gifted him from the inheritance your wife received from her mother’s probate! Let's explore more.

The answer to “Can I Deduct Property Taxes?” is not simple. Hopefully, this article will give you a better understanding of when you can deduct property taxes.

Yes, you can deduct a portion of your home rent for your home office on taxes – but as always , this benefit is only available if certain conditions are met.

We sold my wife's parents' house. Do we have to pay taxes on it if we put it in a money market account in our name? It depends on a taxpayer's circumstances.

Real estate professionals can claim unlimited losses on rental properties they materially participate in but there are many rules involved in qualifying as one.

If your rental property is incurring losses, those losses may be limited on your taxes based on other income you receive. Let's explore more.

My Aunt died and the bank sold her house. The bank sent me a check for "excess proceeds" from the house sale. Do I owe any tax on this money?

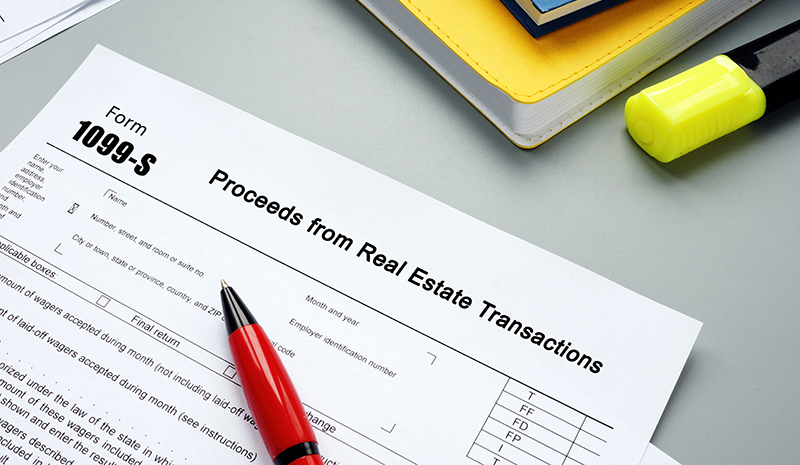

I inherited a property located in foreign country from non-US relative, do I need to file 1099-S? I did not receive 1099-S since the property is not in USA.

There are several different tax breaks available for solar panels used either in the home or in a business. Let’s look at a couple of examples.

When you inherit real property, like a home, then for tax purposes the beneficiaries receive what is called a “stepped-up” basis.

You can "deduct" real estate taxes paid over the course of owning a piece of land in the year the land is sold, if the land was vacant, but there is a catch.

Replacing an entire roof will increase the cost basis of the home. However, any costs paid or reimbursed by an insurance are not added to the home's basis.

Real Estate taxes might be deductible on your personal or business taxes, it depends on your situation. Let's start by looking at the tax assessor’s bill.

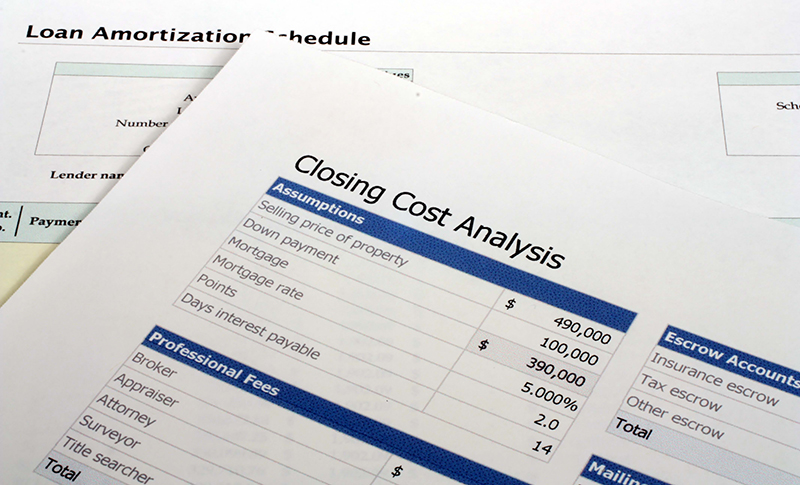

In general, only mortgage interest and property taxes are deductible in the transaction year, while some expenses and fees can be added to the cost basis.

Consider the potential risks and benefits before adding an adult child or caregiver as an owner of your home, bank account, credit card, or any other asset.

The IRS generally considers your primary residence to be the home where you spend the most time, but also looks at numerous other factors.

Costs for home improvements, such as a new roof, add to the cost basis of your property and will reduce your taxable gain when you sell your home.

The reality is you can sell your house to your child, grandchild, or anyone else for that matter, for $1. But just because you can doesn’t mean you should.

Many people try to guess the amount of their closing costs and use that for their taxes. If they are ever audited, this would not likely work out well for them.

For federal tax purposes, there is no deduction available at this time. However, the loss may or may not be deductible on your state tax return.

The answer to this depends on your particular financial circumstances, how much you owe the IRS, and why you owe them money in the first place.

Real estate closing costs can be pesky things. And since you are paying for them, can you at least deduct them from your taxes?

In regard to the personal home mortgage interest deduction on the Schedule A, the answer is yes, but only if certain criteria are met.

Before signing on the dotted line, it’s important to understand the potential tax, liability, and equity issues of transferring your house deed to your child.

Below is a list of misconceptions and examples of misinformation taxpayers may encounter during the upcoming tax season.

My boyfriend and I are buying a house together, and the property includes a rental apartment above the garage. How should we report our rental income?

My husband and I bought a home. We sold our old house a few months later. Will the profit on the old house be taxed if we do not roll it into the new house?

The expenses I paid out on my rental were $12,000 more than my rental income, yet my tax return shows a deductible rental loss of zero. Why?

I inherited a home in 1988 from my father. I sold that home during the 2014 tax year at a gain. I did considerable renovations on this property...

I just had my home refinanced to a lower interest rate and to a 15-year fixed mortgage. What are some of the things that are associated with refinancing...

We had solar put on our house this year. Is it tax deductible? A tax credit is available for qualified solar electric property costs and qualified solar water..

I had a new roof put on the house. Is it tax deductible? A new roof is generally considered to be an improvement to the structure.

If I'm going to do home repairs, such as a roof and heating, which will cost about $15,000, would it be better to take out a home equity loan to pay for it or..

We live in Florida, and we are thinking about buying a second home in Maine for the summer months. Will we be able to deduct the mortgage interest on our taxes?

We bought our home in 2009, in Arkansas, did major improvements, and then leased it out from 2010 though 2014. We now have the place up for sale...

My personal residence cost basis is higher than the expected sale price. Is there a way to get a tax benefit from a loss on this property?

I completed a short sale in 2014 and was wondering if it’s possible to avoid taxes on the difference. I sold it for $142,000, the bank got $127,000, and the...

My house got water in it this past month. I needed to clean up the mess, replace the carpet, pad and doors. My insurance would not cover the loss.

How do you know if you have spent substantially full time repairing and maintaining a rental property when you stay in it so it doesn't count as a personal day?

We took out a home equity loan to redo our basement. The contractor did not perform the work as agreed and what was performed had to be torn out...

I have a good friend who owns two rental homes here in California. The tales he tells regarding these “assets” are not for the faint of heart.

I bought a house in Arizona in 1996 for $95,000. I did two cash-out refi’s totaling about $30,000 through 2004. I sold the house in 2014 for $165,000, and..

I gave my daughter $10,000.00 for a down payment on her house. It was earmarked in our trust to be paid to her on our death. I inherited the money from her...

We recently bought our 1st home via FHA mortgage, which included monthly mortgage insurance premium (MIP). In addition, an "up-front" MIP amount (UFMIP)...