All About IRS Notice CP08 | Additional Child Tax Credit

June 05, 2024 by Charla Suaste

No one ever wants to open their mailbox to find a letter from the IRS tucked inside. But in the case of receiving an IRS CP08? It could be a different story!

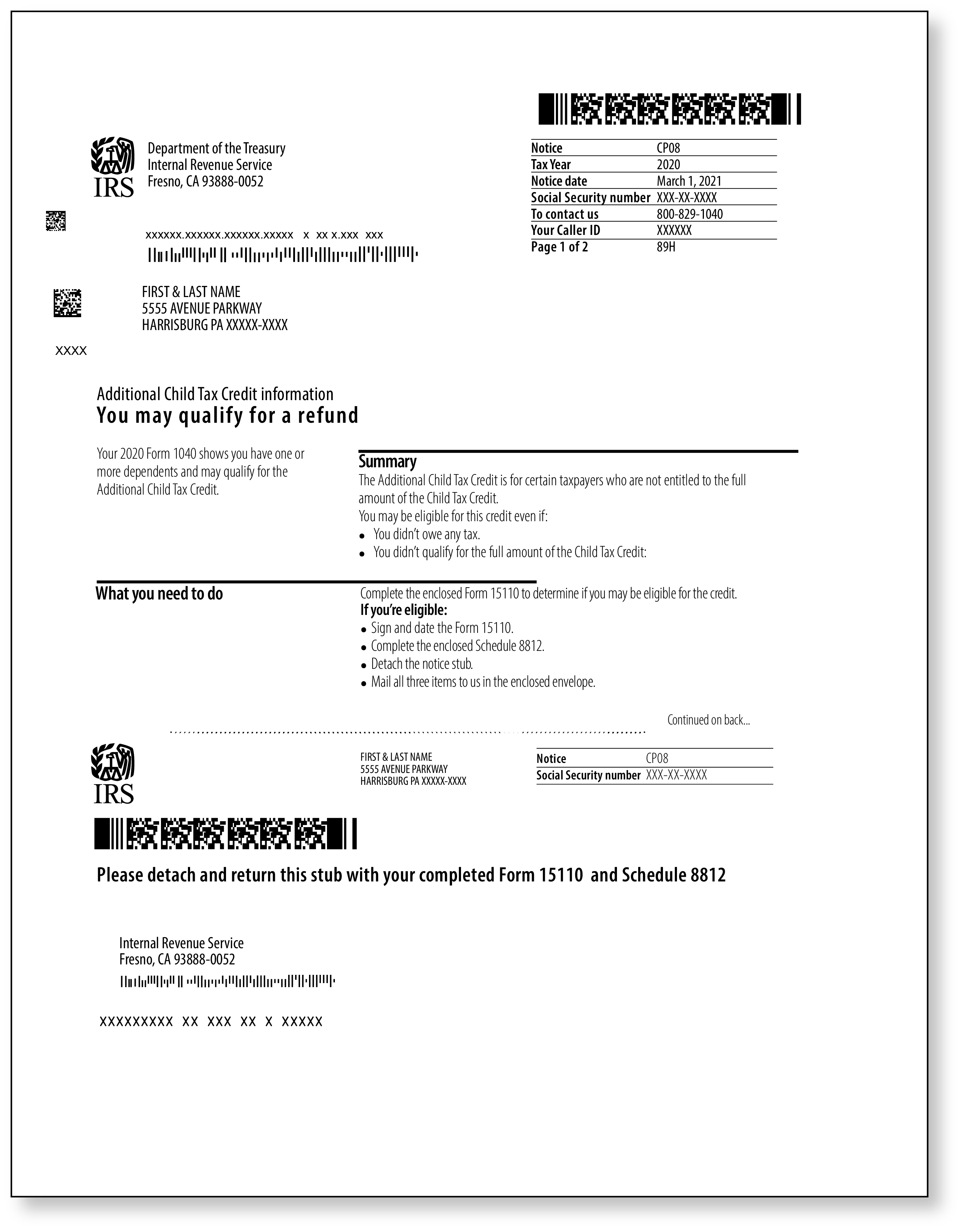

A CP08 is issued if the IRS believes a taxpayer is entitled to certain tax credits that they did not claim on the corresponding tax return. More specifically, a CP08 is to let taxpayers know that they may qualify for the Additional Child Tax Credit and, in turn, could be eligible to receive a refund.

So, if you’ve received this type of notice, what steps should you take next?

First, read the notice top to bottom, front to back. Take note of what tax year the notice is regarding and the deadline by which the IRS needs a response.

The notice should also include Form 15110, Additional Child Tax Credit Worksheet, as well as Schedule 8812, Credits for Qualifying Children and Other Dependents. Your next step would be to fill out the worksheet on Form 15110 to verify that you have at least one qualifying child to claim the credit. If you do, complete both that form and Schedule 8812 and prepare to send them off to the IRS. You can do that by:

- sending the documents to the IRS using the envelope they provided,

- going to the post office and sending the documents via certified mail to the address listed on the top left-hand corner of the notice or

- scan the documents using the IRS Documentation Upload tool. (Keep in mind that this is not available for all notices. If it is available in your specific case, there will be an access code listed on your notice.)

The next step will be to wait to hear back from the IRS, which can take some time.

If, after reviewing your documentation, the IRS does not believe you qualify to claim the Additional Child Tax credit, they will send you a notice letting you know why. There may be an opportunity for you to dispute their determination if you have the proper documentation.

If they determine that you do qualify for the credit, you should receive a refund in the next 8-10 weeks.

If you have not received a response or refund from the IRS after 10 weeks, call the IRS at 800-829-1954 to check on the status of your case.

However, if you received this IRS notice and have a membership with TaxAudit, call us instead! We will have you send us a copy of the notice you received along with the corresponding tax return and then assign a qualified representative to your case. This individual will correspond with the IRS on your behalf, which includes reviewing and sending all documentation to the taxing agency, as well as making any necessary follow-up phone calls. We correspond with the IRS so you don’t have to! If you would like to start a case with us or are curious about what a membership with us entails, click here for more information or call our Customer Service Department at 800.922.8348 and they will be happy to help!