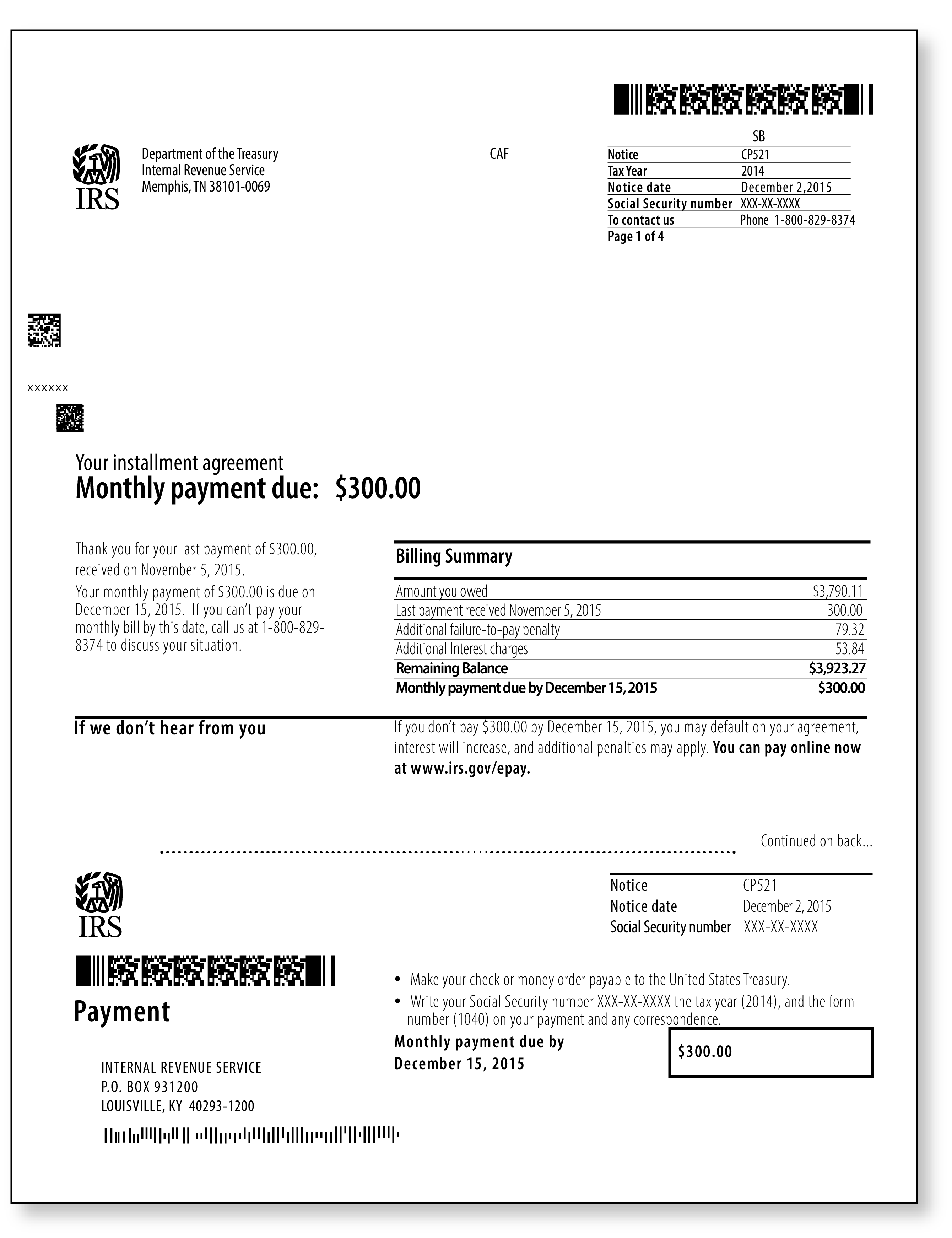

IRS Notice CP521 | Installment Payment Due

January 15, 2024 by Kaylie Jonutz

It is inevitable for many taxpayers that, at some point in life, they will owe taxes to the IRS – and finding out you owe a particularly large dollar amount to the IRS is enough to make anyone panic. How am I expected to pay this off? I don’t have that kind of money to send to the IRS! However, before you go into full panic, remember that you can enroll in an installment payment plan. With an installment agreement, you can make payments to the IRS over a period of time instead of having to pay one large lump sum all at once.

What is an IRS notice CP521 and why did I receive it?

If you received an IRS notice CP521, it is because you entered into an installment agreement with the IRS for taxes owed and your monthly installment payment is now due.

What should I do now?

For this notice, what you need to do is simple – and that is to pay the minimum amount listed on the notice. The easiest way to do this is by making a payment online. If you do not want to make a payment online, you will need to mail a check for at least the minimum amount due using the envelope that was provided. If this is the route you decide to take, make sure to include the bottom part of the first page of the notice, known as the payment stub, in the envelope to make sure that the IRS accurately credits your account.

How do I get a copy of this notice if I misplaced it or need to make changes to my installment agreement?

Lost your notice and do not have the payment stub to send with your check? No problem! A copy of your notice may be accessed by logging onto your IRS Online Account. In addition to printing a copy of your notice, you can request modifications to your installment agreement (such as changing the date the monthly payments are due) online. You can also request to revise your payment method from direct deposit to check or vice versa. The IRS also allows you to adjust the monthly payment amount. Keep in mind that if you request to reduce the monthly payment below the amount needed to satisfy the balance due within the installment agreement payment period, the IRS may request additional financial information. Changes to installment agreements may be completed by logging onto the IRS Online Payment Agreement tool.

What happens if I don’t pay?

If you do not make your installment payment by the day it is due, you will accrue interest and penalties that will increase the amount due. Along with this, there is a possibility that you could default on your installment agreement.

What if I already paid the entire balance due in full and I received this notice?

If this happens, it is recommended that you reach out to the IRS and confirm that all your payments were received and applied to the correct tax year. If you are an Audit Defense member and disagree with the letter, you do not have to deal with this notice alone! If this is the situation you are in, contact us immediately, and we will guide you through the next steps.

If you are not a member, consider signing up for our Audit Defense membership in the event that you receive any future audit letters or notices. TaxAudit is here to assist you with the audit process and make sure you never have to face the IRS alone!