I got an IRS Notice CP11 - What should I do?

January 06, 2023 by Courtney Visser

You’ve just returned home after a long day of work and immediately head out to check the mail like you do every evening. After sifting mindlessly through the expected junk mail, you reach the bottom of the pile, and those three dreaded letters pop out at you: I-R-S. You nervously open the envelope and reluctantly begin reading.

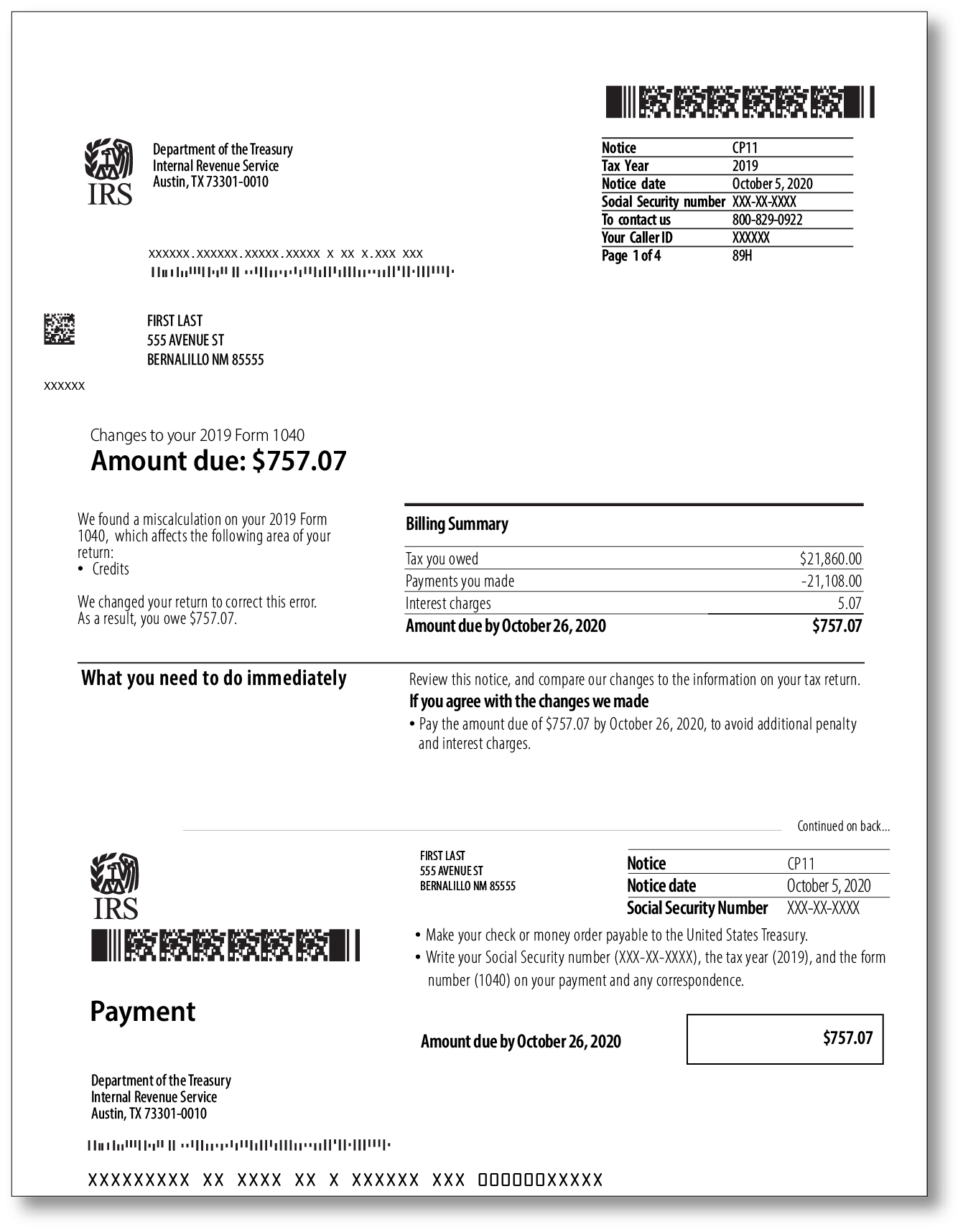

As you examine the letter, you realize that you’ve received a CP11 notice similar to the one below. It explains that the IRS has made changes to your return in order to correct a miscalculation they believe you made while filing your taxes. Adding insult to injury, the notice also states that you now owe additional taxes as a result of these changes.

So, the question arises: What should you do now?

Rule number one: Don’t panic! Dealing with the IRS can be an intimidating process. It may feel overwhelming for those with a limited understanding of taxes, but there are plenty of resources available for people who find themselves in these stressful situations.

According to the IRS website, the first thing you should do is study the notice carefully. It will explain the changes the IRS has made and why you owe the extra money on your taxes.

If you agree with the changes proposed by the IRS on the CP11 notice, you have a couple of options when it comes to repayment. The first is to simply pay the amount owed by the due date on the notice. However, if you’re unable to pay the full amount by the deadline, you may have the option to make payments toward the amount due. The IRS even has an online payment agreement tool on its website where you can easily set up a payment plan that suits you.

On the other hand, if you disagree with the changes made by the IRS, you’ll need to let them know within 60 days from the date on your CP11 notice. According to their website, the fastest way to resolve most return errors is over the phone. If you prefer, you can also contact the IRS by mail. Just make sure that you include a copy of the CP11 notice along with any correspondence you send in, and be ready to wait 30-60 days or more for a response. As with all mail sent to the IRS, it is best to mail your response via certified mail with a return receipt request to confirm the response arrived at its destination.

In some cases, the IRS may request an explanation or documentation to substantiate your claim. However, when it comes to CP11 notices, taxpayers are not required to provide an explanation of why they disagree with the changes that the IRS has made or provide documentation proving their tax position when requesting that the IRS reverse their changes. That being said, if the taxpayer doesn’t present an explanation or any documentation substantiating their position, the IRS may decide to audit the return.

So, a taxpayer should carefully weigh the pros and cons of not providing an explanation or any documentation to support their position. Regarding changes the IRS makes to withholding or estimated tax payments, keep in mind that the IRS is not required to reverse these changes unless the taxpayer can provide documentation that verifies the amounts they reported on their tax return. The critical thing to remember is that you must request that the IRS reverses the changes they have made within 60 days from the date on the notice. If the request is not made in time, the taxpayer will lose their appeal rights to reverse the changes made by the IRS before paying the tax due.

In any case, it’s usually best to consult an experienced tax professional when you receive any type of IRS notice. With an Audit Defense membership, our members can receive expert tax representation and enjoy the peace of mind that comes with not having to face the IRS alone!

TaxAudit’s team of tax attorneys, CPAs, and Enrolled Agents are ready and willing to help members every step of the way until their case is resolved. As the largest tax representation provider in the country, TaxAudit handles more audits than any other firm. For more information, visit our website here or call 800-922-8348.