TaxAudit Blog: Is It Deductible?

Find out which job-related expenses law enforcement officers can deduct, who qualifies for exceptions, and what documentation is required.

Is car loan interest tax deductible? Learn how the OBBBA allows up to a $10,000 auto loan interest deduction for qualified vehicles from 2025–2028.

Learn how gambling losses are taxed under the new 2026 rules and what records you need to claim deductions on your tax return.

Discover how changes to the SALT deduction can reduce your federal tax bill—especially if you live in a high-tax state or itemize deductions.

Learn if daycare is tax deductible and how the Child and Dependent Care Credit can help reduce your tax bill if you meet key IRS criteria.

What expenses do you incur because of your ridesharing gig, like Uber, can you deduct? How do you properly report and keep track of them in case of an audit?

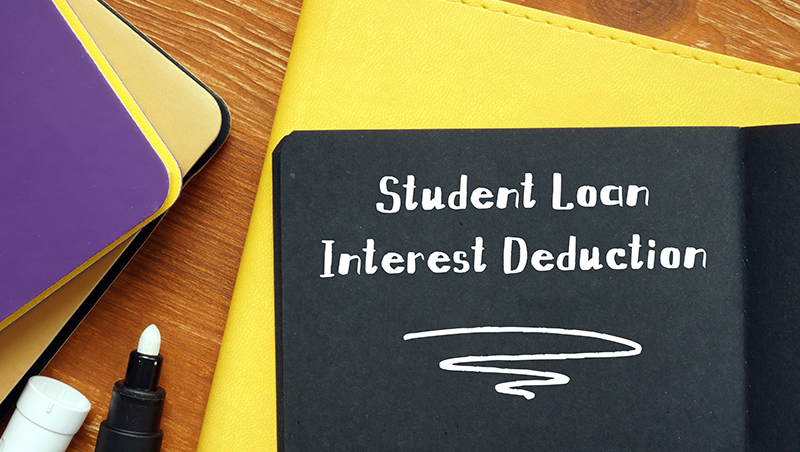

The actual amount of interest paid on loans taken from foreign lenders may be eligible for the student loan interest deduction. Let's explore more.

The Tax Code offers two tax credits for college tuition paid. Each credit has different requirements, which determines the benefit an individual is eligible.

If you use your vehicle for your independent contractor business, you may be able to take a deduction on Schedule C for the business use of that vehicle.

Yes, moving expenses can be tax deductible, but only if you meet the requirements of one of the circumstances noted in this article. Let's explore more.

Yes, interest you pay on business and personal credit cards may be deductible, but the amount you can deduct depends on the type of purchases you have made.

Yes, car insurance can be tax deductible for self-employed taxpayers, Armed Forces reservists, qualified performing artists, and some government officials.

PMI, funding fees, and guarantee fees can be deductible if you qualify. One qualification is your mortgage loan must have been taken out between 2007 and 2021.

If you have qualified student loan interest, you may be able to take a tax deduction for a portion of what you paid on your federal income tax return.

In this article we will discuss some key issues related to whether life insurance is tax deductible and a few potential tax benefits of life insurance.

There is a very good chance you can deduct mortgage interest on a second home – but it depends on the details of your situation. Let's explore more.

When certain medical expenses aren’t covered by a health insurance plan or have a high deductible, the IRS allows a tax deduction on the individual tax return.

Yes, you may be able to deduct mileage and gas on your taxes, but only if you meet certain conditions. Please allow me to explain.

The losses you incur from your gambling activities may be tax deductible, but the total amount of your deduction cannot exceed the amount of gambling income.

You are an influencer and have a large enough following that you are making money from your online posting. What kinds of expenses can you deduct on your taxes?

Alimony payments may indeed be tax deductible if the divorce or separation instrument under which they are made was executed prior to 2019.

When you give assets to family members, they are subject to the gift tax exclusion amount, currently $17,000 per year. If your gift exceeds this amount...

Groceries you buy for your household are a personal expense and are not deductible. But there are numerous cases in which food can be deductible.

There is no tax benefit for applying to enter a college. However, many benefits are available when your application has been accepted and after you enroll.

Kenneling a dog for work travel is considered a personal expense. However, I wonder if the answer is different if I make income from my dog?

How do I write off solar panels for rental properties when I claim as a real state professional to run a rental business?

Whether you can deduct credit card interest on your taxes depends on the use of a credit card. Are you using it for personal, business, or perhaps both?

The deductibility of origination fees on your taxes from buying a new home is dependent upon a few factors - the main factor being if itemize your deductions.

While homeschooling, can you deduct the cost of classes for skills that the homeschooling parent doesn’t possess, such as ballet classes or piano lessons?

You can use the US tax code to reduce the impact of foreign taxes you have paid or incurred depending on the country or countries involved.

You can deduct an unpaid invoice as a business expense if all the following are true: (1) You have already included the amount of the invoice as income…

As the law currently stands for individual taxpayers, starting in the 2026 tax year, you will be able to deduct estate planning fees related to tax planning.

Now that the pandemic is officially over, can I still deduct the cost of masks and hand sanitizer for my classroom or place of business? Let's find out.

If you want to deduct your first-class airfares, be aware that the IRS may question you about these expenses and will make its decision based on each trip.

Yes, you can. Provided that the baby in question is your dependent, there is a whole host of tax benefits you can take advantage of to offset your expenses.

Your GoFundMe donations can be deductible provided that they are being sent to the correct type of organization - a registered 501(c)(3) organization.

The deduction of any expenses, including snacks for riders from rideshare drivers, depends on your personal facts and circumstances. Let's explore more.

Tax law does allow business owners to use the gifts they made to clients to increase their deductions from taxable income, but there is a dollar amount limit.

The deductibility of an IRA contribution is affected by your filing status and your Modified Adjusted Gross Income and is subject to certain limits.

As a rideshare driver you can likely deduct your carwash expenses on your taxes. But, as always, certain conditions have to be met. Allow me to explain.

With all the required tuition, books, and fees for college students, not to mention the cost of room and board - what education expenses are tax deductible?

Under some circumstances, you can indeed deduct off-campus housing on your taxes while attending college – but the amount of the benefit is limited.

Are there situations where travel expenses are tax deductible? Yes. In this blog, we will discuss five situations where travel expenses are deductible.

The IRS regards your personal driver’s license as a nondeductible expense. A commercial driver’s license that is required for your business may be deductible.

The good news is there are many different expenses that you may be able to deduct in relation to your dog-walking job – but your shoes may not be among them.

The short answer is yes, you can deduct education expenses for your dependents, but some limitations and qualifications must be met. Let's explore more.

Tax law does not allow us to claim last year’s expenses on this year’s return, but does allow us to amend our returns to include missing deductions.

The good news is that, at tax time, taxpayers can often deduct part or all of the premiums they pay for long-term insurance for themselves or a dependent.

Whether you use your second home for personal or business purposes, the interest you pay on the mortgage may very well be deductible on your tax return.

Yes, the tax code allows you as an individual to deduct the sales tax you paid during your tax year but, first, you must meet certain conditions.

If you are self-employed, you may be able to deduct your home office internet expenses on your taxes. Let's review the guidelines for an internet deduction.

The answer to the question "Can I Deduct Federal Taxes Paid?" is maybe – it all depends on where you live or what you do for a living. Let's explore more.

Generally speaking, to deduct donations or contributions to your church, you must itemize your deductions on Schedule A (Form 1040).

HOA fees are not deductible for a property used as your private home all year. But there may be a deduction for those who use their home for business purposes.

According to the Federal tax laws, unreimbursed COBRA payments are deductible as medical expenses on your tax return if you qualify to itemize your deductions.

There is a very good chance that you can deduct your Medicare Premiums that you paid on your taxes. As always, there are different conditions that must be met.

Dental expenses (if qualifying) can be included on Schedule A, Itemized Deductions - Medical and Dental Expenses, subject to a 7.5% Adjusted Gross Income.

Kindergarten tuition is not deductible because the costs to attend are considered educational expenses. However, qualifying childcare expenses are deductible.

Yes, you can indeed receive a tax benefit for installing new energy efficient windows on your house – provided that certain conditions are met.

Whether you can write off karate classes on your taxes relies heavily on your personal circumstances. Let's explore more.

If you meet the conditions for the home office deduction, you are allowed to deduct a portion of your home insurance premium.

There are some tax-saving opportunities available for graduate school tuition, like the credits for undergraduate expenses. They each have some limitations.

When it comes to medications, you can only deduct the amounts that you pay for medicines or drugs that have been prescribed for you by a doctor.

Can Grandparents take a deduction for paying the preschool tuition costs when the child still lives with the parents? To qualify you must meet the following.

Generally, the costs of moving or disposing of items are considered personal expenses and are not deductible, even though removing the items are required.

Because of changes to tax law in 2018, Schedule A deductions for advisory-type expenses will not be available until 2026 at the earliest.

Employees cannot deduct dry-cleaning costs on federal taxes until 2026, but self-employed individuals can take the deduction by meeting 3 qualifying tests.

Yes, you can deduct your business meals – but there are conditions that must be met. Under normal circumstances, qualifying business meals are 50% deductible.

Medical expenses are deductible, but whether or not you can claim this deduction depends entirely on the amount you spent and the amount you earned.

You can likely deduct your out-of-pocket assisted living expenses on your Form 1040 tax return. But, as always, there are some conditions that have to be met.

As with most tax questions, the answer to this question can be a little complicated. Dependent adult children will fall into one of two categories.

Are attorney’s fees deductible on my tax return? The answer, like a lot of answers to tax questions is: Sometimes yes, sometimes no. Let's explore more.

Accountant fees for a business purpose are generally deductible, but when those fees are incurred for a personal purpose, they are currently not deductible.

The qualified business income deduction is calculated by taking the income and losses from all your business activities and netting them into one amount.

The costs of utilities can indeed be deductible under certain circumstances, so let us talk about those occasions when you can deduct your utility expenses.

Yes – there are quite a few different personal and business taxes you may be able to deduct. But, as always, it depends on your particular situation.

For most taxpayers bank fees are not deductible. However, taxpayers who operate their own business may be able to deduct bank fees.

There is a very good chance you can get a deduction on your taxes for the State sales taxes that you had to pay on your new car, truck, van, or other vehicle.

The answer to “Can I Deduct Property Taxes?” is not simple. Hopefully, this article will give you a better understanding of when you can deduct property taxes.

Yes, you can deduct interest on your business and personal credit cards to the extent that the interest relates to business expenses. Let's explore more.

Yes, you can deduct a portion of your home rent for your home office on taxes – but as always , this benefit is only available if certain conditions are met.

The surprising answer is yes – you can deduct some of your wedding expenses from your taxes under certain circumstances. Let's take a closer look.

Certain categories of employees can claim the deduction for unreimbursed employee business expenses, but not all. Let's explore some examples.

Insurance policies may cover part of nursing home costs and the unreimbursed expenses can often be deducted on a Form 1040 individual tax return.

Rent can be deductible, but it depends on what is rented, the purpose of the rental, who receives the rental payments, and the terms of the rental agreement.

Since the government considers your vehicle to be just another piece of property, so is there a tax deduction for the theft of your car? Let's find out.

There are some parts of the tax code that, in fact, can allow tuition fees to be fully deductible. However, in most cases you cannot deduct private tuition.

We had a water leak in our home. The clean up used chemicals which caused us to get rid of our clothing, bedding, and furniture. Is this deductible?

If you volunteer for an organization, do you get a tax deduction for your time or talent? Let's also look at volunteering use of property and other expenses.

Whether an amount paid for taxes as the result of an IRS or state tax audit is deductible depends on the type of taxes involved. Let's explore more…

Is there relief from the government in the form of a tax break? Like many things in taxes, this can depend on different things, such as what caused the fire.

A taxpayer with a sole proprietorship and reports business income and expenses on a Schedule C may claim a prorated amount of the Audit Defense Membership.

Under certain circumstances you can indeed claim a tax benefit for preschool tuition - called the Child and Dependent Care Expenses tax credit.

The results of the Tax Cuts and Jobs Act have made brokerage fees non-deductible for any returns filed between 2018 to 2025.

If you operate a business from inside your home, the home office deduction can be one of the largest deductions you can take as a tax write-off.

My wife drives to transport our granddaughter to our house to watch for the day. Is this to-and-from mileage deductible as a job-related expense?

As a self-employed taxpayer, you can deduct your business-related parking fees as an expense on Schedule C, Profit and Loss from Business.

There are several different tax breaks available for solar panels used either in the home or in a business. Let’s look at a couple of examples.

You can "deduct" real estate taxes paid over the course of owning a piece of land in the year the land is sold, if the land was vacant, but there is a catch.

For 2020 taxes, the CARES Act allows individual taxpayers who do not itemize to claim a deduction up to $300 ($150 for MFS) for cash charitable contributions.

Overall, two things are important when determining if you can deduct your zoo membership. The first is what type of organization is the zoo? Is it a non-profit?

Depending on the nature of the education, there may be an avenue to account for work related education expenses on one's tax return.

Funeral and burial expenses can be deducted if they were paid out by the estate of the deceased person. However, most estates never use this deduction.

Real Estate taxes might be deductible on your personal or business taxes, it depends on your situation. Let's start by looking at the tax assessor’s bill.

The general rule is that you can deduct the costs of vitamins as a medical deduction only if your doctor prescribed them to treat a specific medical condition.

You can deduct certain state and local taxes (SALT) if you choose to itemize deductions on your tax return rather than claiming the standard deduction.

There is a very good chance that you can indeed deduct the cost of your oil changes if you use your car or truck for business purposes. Let's look closer at it.

Yes, of course – well, maybe. Like many tax deductions, the student loan interest deduction for parents comes with a list of conditions that must be met.

The cost of baby formula for your own infant is generally not considered something you can write off on your taxes. However, there are exceptions.

A tax deduction for qualified tuition expenses has generally been available for many years. However, it has never been a permanent part of the tax code.

For individual taxpayers, the cost of driving your vehicle for work is not an allowable deduction for tax years 2018 - 2025. This rule does not apply…

Costs for home improvements, such as a new roof, add to the cost basis of your property and will reduce your taxable gain when you sell your home.

It all depends on your babysitting gig. Are you employed by an agency to work as a babysitter? Or are you self-employed with your own babysitting business?

Under current federal law, union dues are generally not deductible. However, there are a few exceptions, and if your union dues meet one of them you are in luck

For federal tax purposes, there is no deduction available at this time. However, the loss may or may not be deductible on your state tax return.

From a tax standpoint, a relationship that is established by marriage, such as your relationship with your mother-in-law, does not end with divorce.

The most likely answer for most people would be no, as the general rule is that you cannot deduct the cost of the gym membership. However, there are exceptions.

Even if you cannot deduct your unreimbursed business expenses for your federal return, you may still be able to deduct them for your state return.

If the taxpayer has costs for after school care of a qualifying dependent, those costs may provide some tax benefits. Let's explore these tax benefits.

Sales tax on a car or automobile purchase might be deductible. It depends on the taxpayer’s circumstances. Generally, the following conditions must all be met.

Just like there are hundreds of poses in yoga, the tax law is not so simple - and there are subtle variations that determine whether the answer is yes or no.

Yes, under certain conditions, health insurance premiums are tax-deductible. Generally, the health insurance premiums can be deducted in one of two ways.

Real estate closing costs can be pesky things. And since you are paying for them, can you at least deduct them from your taxes?

In regard to the personal home mortgage interest deduction on the Schedule A, the answer is yes, but only if certain criteria are met.

Prescription eyeglasses for correcting your vision are deductible as a medical expense, but you may not be able to deduct them based on other factors.

If you paid off a prior year state or local tax obligation to your state, you can include these payments as a state tax deduction, subject to the $10,000 cap.

Yes! Losses on bitcoin and other virtual currencies are deductible but be aware that in an audit the IRS can and will disallow any improperly claimed losses.

When it comes to the deductibility of business expenses the answer is likely to be “Yes, No, Maybe So, or Not Now.” Here are a few examples to consider.

As part of the tax reform laws, the home office deduction was eliminated for all tax years from 2018 through to 2025 for taxpayers who are employees.

Lottery earnings are generally reported on Form W-2G, taxed as ordinary income, and expected to be reported as “other income” on the federal tax return.

Have you or someone you know experienced loss from a disaster? You may be able to deduct the loss you incurred on your federal income tax return.

Some people can claim an exemption from the health insurance requirement, but everyone else needs to show the IRS that they are covered or else pay a penalty.

I spent 30K on a new roof last winter after my old one collapsed under 100 inches of snow. Where do I report the cost of the roof on my taxes?

"We have our own marketing and design business. This year we ordered expensive gourmet chocolate gift baskets for each of our ten clients to thank them..."

While I was working out at the gym, someone broke into my locker and stole my diamond ring. It’s my wedding ring and I always take it off before doing...

I do PR in the Bay Area. My hairstylist says I can deduct my entire salon bill on my taxes because it helps me look good at events. Is this correct?

I want to donate to my favorite politician’s 2016 campaign for our state’s House of Representatives. Are there limits to how much I can deduct?

My husband spends a lot of time printing church service bulletins and other special design and print jobs. Can he deduct the time he works as a volunteer?

My wife is training to begin her career as a life coach. Can the expenses of her training, including tuition, room, board & travel, be tax deductible?

You might have thought that with the new Health Care Reform more of all the money you spend on health insurance and medical expenses would be deductible.

How many miles can I claim on my tax return when driving for work?

With the costs of obtaining a Master of Business Administration skyrocketing - often costing up to $80,000 - you might be wondering: is my MBA tax deductible?

My brother was moved to a nursing home/memory care unit. He had to live in the nursing home area until the memory care unit had an opening. When he was in...

My wife and I bought a townhouse in 2014. What tax deductions can we take?

My wife has an IRA under professional management with a financial advisor here in Portland. Can we deduct the fees charged for his services?

I use suits for work, and the dry cleaning expense is substantial. I don't use the suits outside of work. Can I deduct the dry cleaning as a business expense?

The holiday season is a time for giving, but if you don’t follow the carefully prescribed rules for charitable giving, the IRS may disallow your deduction.

We had solar put on our house this year. Is it tax deductible? A tax credit is available for qualified solar electric property costs and qualified solar water..

We loaned our car to a missionary home for a visit and fundraising. Can we deduct the mileage as a charitable contribution?

I had a new roof put on the house. Is it tax deductible? A new roof is generally considered to be an improvement to the structure.

Can I claim the interest I pay on my RV on Schedule A as mortgage interest on a second home? As long as your RV loan is secured by the RV and the...

I had bariatric surgery and must take a number of vitamins daily. These vitamins are purchased over the counter without a prescription.

We live in Florida, and we are thinking about buying a second home in Maine for the summer months. Will we be able to deduct the mortgage interest on our taxes?

My brother is in assisted living; what part of his expenses can be deducted? He needs assistance with getting dressed and all daily hygiene activities.

Let’s talk about business deductions for members of the military. The same rules apply for active duty personnel and reservists.

My house got water in it this past month. I needed to clean up the mess, replace the carpet, pad and doors. My insurance would not cover the loss.

I live in Georgia but work in the oilfields of Alaska as a Form 1099-MISC contractor. Am I allowed to deduct my airfare and hotel and meal expenses for travel?

Could you advise on how the value of items is determined for charitable contributions? I am about to donate several of my designer suits to charity.

We adopted our grandson three years ago - he is now a freshman in high school. When he goes to college, will his tuition be tax deductible?

We took out a home equity loan to redo our basement. The contractor did not perform the work as agreed and what was performed had to be torn out...

I took out a medical loan for $36,000 dollars for full mouth restoration by two dentists due to infections. My insurance only covered $890. Can I deduct it?

I travel for a living and my company knows I have pets. I have to have them kenneled when I am traveling for work. Can I expense the cost of the kennel stay?

I use my car in my business. How much of it is tax deductible, and what type of travel is deductible? Are my trips going back and forth to work deductible?

I gave my daughter $10,000.00 for a down payment on her house. It was earmarked in our trust to be paid to her on our death. I inherited the money from her...

We recently bought our 1st home via FHA mortgage, which included monthly mortgage insurance premium (MIP). In addition, an "up-front" MIP amount (UFMIP)...

I was an owner contractor on the restoration of my house. I bought some used construction equipment to do the work, items like gas powered pressure washer...

Our adult Sunday School class had a Christmas project of supplying Christmas clothes and toys for a needy family with several children and a disabled father.