TaxAudit Blog: Tax Professionals

Lottery earnings are generally reported on Form W-2G, taxed as ordinary income, and expected to be reported as “other income” on the federal tax return.

When a person is ineligible to receive a Social Security number, an Individual Tax Identification Number or ITIN must be obtained in order to file a tax return.

This installment of Know Your Pro will introduce you to a different kind of Pro here at TaxAudit. With in-depth knowledge of all the services we offer...

A long time ago, before there were tax software programs, before our social welfare programs were written into the Internal Revenue code, and when Federal...

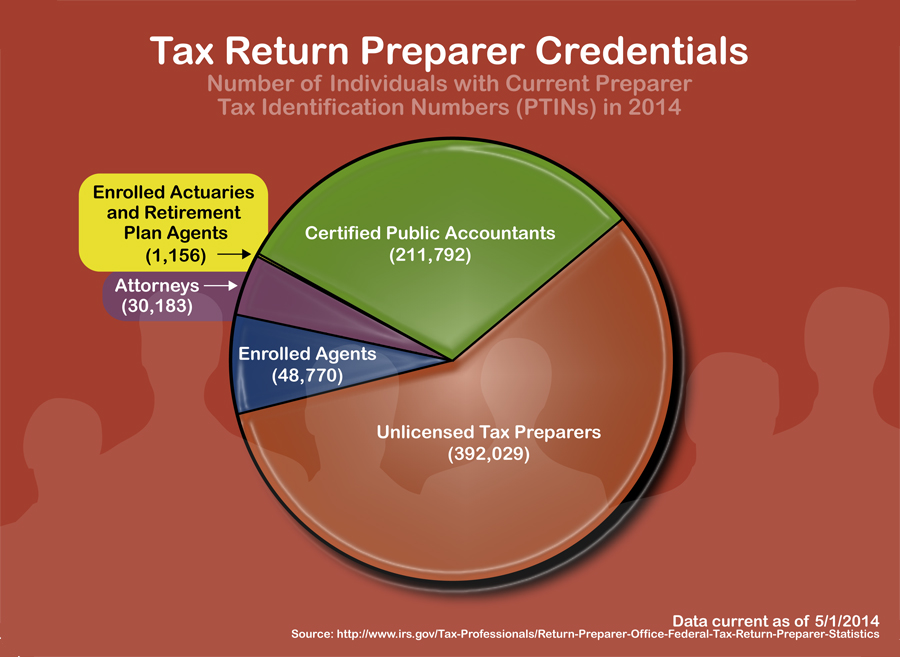

All paid tax return preparers are required to have an IRS PTIN (Preparer Tax Identification Number) which they must enter on the tax returns they prepare.

They say that happy employees make for happy customers, and at TaxAudit those happy employees start with managers like Eric.

Enter Dave Du Val! Dave is our Vice President of Customer Advocacy and among many other things, a tax expert. He sat down with me and set my head straight.

Introducing Carolyn Richardson! Our highly effective and experienced tax audit professional from Hawaii! With her three decades of tax experience,…