IRS Letter 105C | What It Is And How To Appeal

December 18, 2023 by Kaylie Jonutz

The only saving grace to tax season is the possibility of getting a refund. However, mistakes may happen while you are filling out your taxes and the IRS may issue you a notice in response.

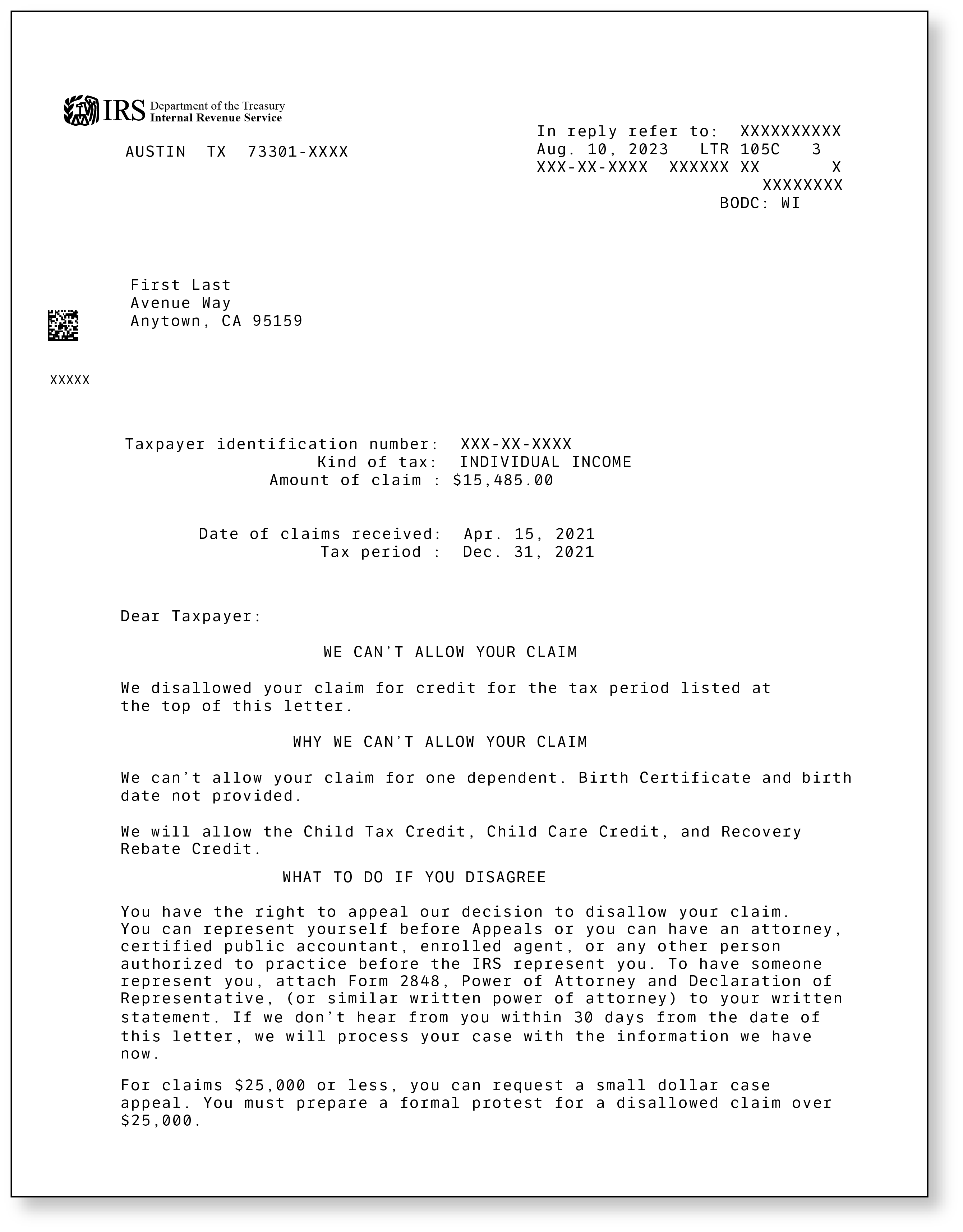

For example, maybe you accidentally entered your kid's social security number incorrectly on your individual income tax return. In turn, the IRS disallowed the Child Tax Credit you claimed on your return. You fix this issue by filing Form 1040-X, Amended U.S Individual Income Tax Return, and explain you accidentally entered your child’s social security number incorrectly on your originally filed return. However, instead of getting a refund check, you receive a 105C notice. The first thing you see on the page is “WE CAN’T ALLOW YOUR CLAIM” and the letter states you got your kid’s social security number wrong again!

We know this is frustrating – but don’t fret! Read this article to learn more about the notice and your options.

What is an IRS Letter 105C and why did I receive it?

You might have guessed it already, but an IRS Letter 105C notifies you that the IRS did not allow the credit or refund you claimed. Generally, a claim for refund regarding your individual income tax return is filed by submitting an amended return on Form 1040-X. Usually, Letter 105C will explain why your claim was disallowed. One of the common reasons why a claim for refund may be disallowed is because it was not filed in a timely manner. In most cases, taxpayers have the later of three years from the date they filed their original return or two years from the date the tax was paid.

What should I do now?

The first action you should take whenever you receive an IRS letter is to read it closely. The reason you received the 105C notice is generally listed on the first page. The IRS will also list the date they received your claim for refund and the tax period the claim was denied.

Because your claim for refund was disallowed, your refund amount may be reduced or even eliminated, or you may have a larger balance due than you anticipated when you filed your original tax return.

What do I do if I agree with the letter?

If you agree with the IRS's decision, you don’t have to do anything except update your copy of your tax return for the corresponding year for your records.

What do I do if I disagree with the letter?

If you disagree with this letter, you must start the appeals process immediately since you only have 30 days from the letter’s date to file an appeal. The date is on the top right of the first page. The appeals process will look different depending on the amount of your claims total. If your claim for refund is over $25,000, you will file a formal protest. However, if your claim is $25,000 or less, you must request a small dollar case appeal. The type of request will dictate what you need to include in your written statement to the Office of Appeals.

Small Dollar Case Appeal (Claim for Refund $25,000 or Less)

To start the appeal process for a Small Dollar Case ($25,000 or under), you must prepare a written statement addressing what you want to appeal to the Office of Appeals. In this written statement, you need to include:

- The tax periods or years and the disallowed items you are disputing and why you disagree with each item.

- Your name, address, taxpayer identification number, daytime phone number, and a copy of your IRS 105C letter.

You should then mail your appeal request to the address at the top of the first page of your 105C letter.

Formal Protest (Claim for Refund More Than $25,000)

To start the formal protest process, you must prepare a written statement addressing what you want to appeal to the Office of Appeals. In this written statement, you need to include:

- The tax periods or years and the disallowed items you disagree with and why you disagree with each item.

- Your name, address, taxpayer identification number, daytime phone number, and a copy of your IRS 105C letter.

- A detailed statement of facts with names, amounts, locations, etc., to support your reasons for disputing the disallowance.

- If you know the particular law or authority that supports your position, identify that law or authority by providing a legal citation.

- A signed copy of the perjury statement the IRS requests. If your authorized representative prepares the request for an appeal, he or she must sign the statement. The perjury statement is below.

- “Under penalties of perjury, I declare that the facts present on my written appeal are, to the best of my knowledge and belief, true, correct, and complete.”

You should then mail your appeal request to the address at the top of the first page of your 105C letter.

Whether you are filing a small dollar case appeal or a formal protest, it is a good practice to mail the correspondence certified with return receipt request. This provides you a record of the date the IRS received the letter.

I submitted my written statement, now what?

After you send your written statement, the IRS will consider the information you provided before forwarding your request to the IRS Independent Office of Appeal for review. It is important to send the appeal in a timely manner because, if it is received late, the Office of Appeals will make a decision based on the information they already have. If you don’t agree with the Office of Appeals decision, you can either file suit with the United States District Court that has the jurisdiction for the case, or with the United States Court of Federal Claims.

It is important to remember that you only have two years from the date listed on the top right-hand side of the first page of the notice to file suit. Within this two-year window, you may not only have to go through Appeals and possibly file suit, but the IRS must issue the refund or allow the credit as well. If time is passing by and you are nearing the two-year mark, you may want to extend the two-year period by filing Form 907, Agreement to Extend the Time to Bring Suit. By submitting this form, you and the IRS agree to extend the two-year deadline to a date both of you agree upon.

Don't want to deal with this alone?

If you have an Audit Defense membership for the year in question, you don’t have to deal with the IRS alone. Our team of experienced professionals will be on your side and help with your case. Along with helping with this notice, our team will also help with any potential future notices for the tax year in which you have a membership. Our tax professionals will make sure that you will never pay more tax than you rightfully owe.

Not a member? Consider signing up for our Audit Defense membership and get peace of mind knowing you have a team of tax professionals on your side.