IRS CP06A | Auditing Your Tax Return and Need Documentation

September 19, 2023 by Kaylie Jonutz

After a long summer camping trip, you stop by the mailbox on the way home to pick up your mail. You sort through the mail once you finally get home from a few hours' drive. You were expecting a few packages; however, you instead discovered an item you did not wish to receive in the mail: an IRS notice. You can’t even fathom having to deal with this notice, let alone taking time out of your busy summer plans to deal with the IRS when you are already preparing for your next summer adventure. How can you relax on the beach while you have the IRS on your brain? The answer is you can’t.

What is an IRS CP06A Notice and Why am I Being Audited?

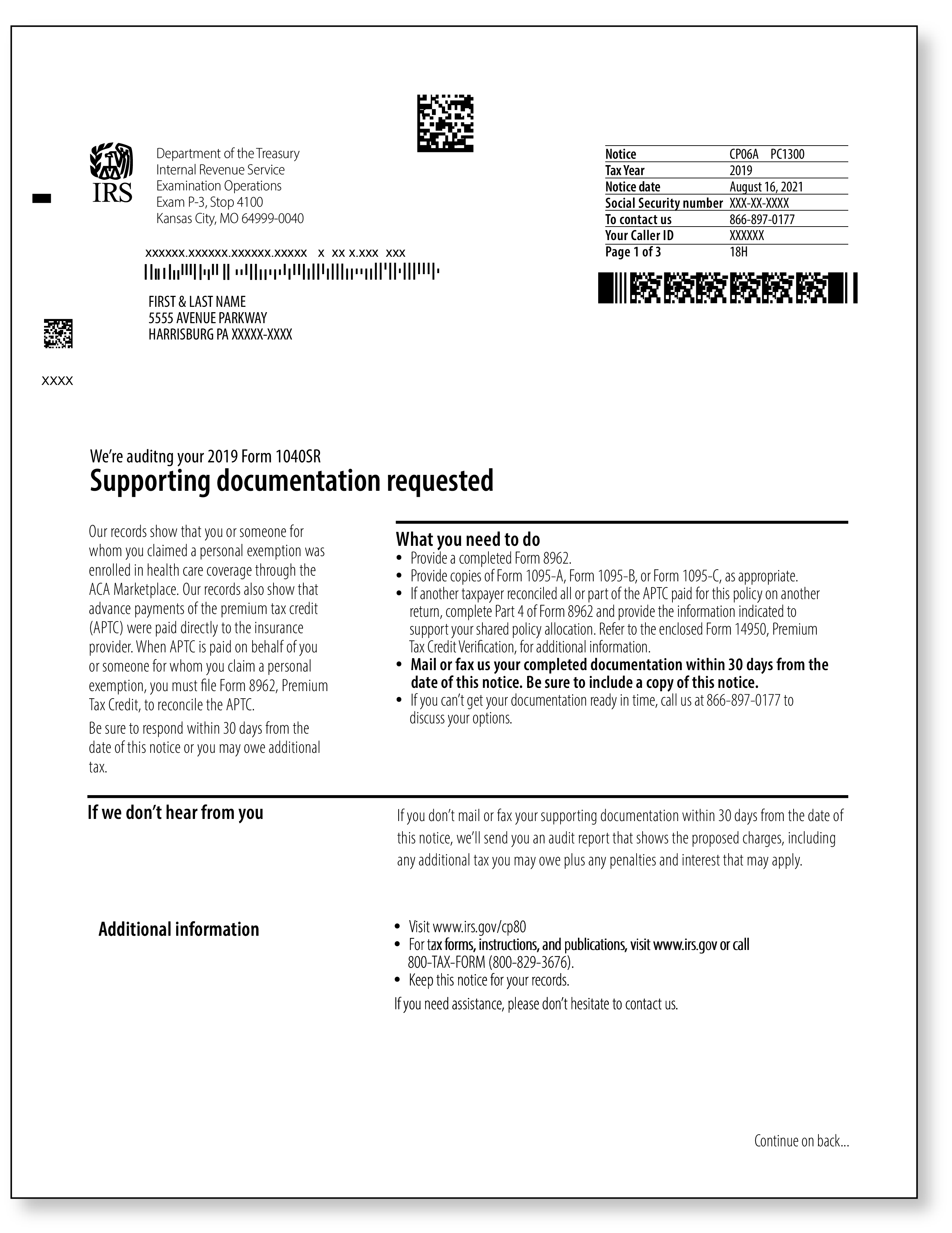

If you have received an IRS CP06A notice that asks you to verify the Premium Tax Credit you claimed on your return with documentation, you have found the right place to educate yourself on what this notice is and how to properly respond to it.

When you receive an IRS CP06A notice, you should also receive Form 14950, Premium Tax Credit Verification, in the same envelope. Form 14950 will ask for Premium Tax Credit verification and will tell you what information you need to send to the IRS.

What Documentation Should I Send?

Along with Form 14950, you must also submit Form 8962, Premium Tax Credit, which should have been included in your original tax return. You will fill this form out regardless if advance payments of your premium tax were paid on your behalf or if you are the one claiming the premium tax credit. If you completed and filed Form 8962 with your tax return, review and double-check the form for accuracy. If you notice any errors within this form, please send the IRS an updated, correct copy.

Other forms/documentation that the IRS requests on the Form 14950 include:

- Form 1095-A, Health Insurance Marketplace Statement

- Form 1095-B, Health Coverage

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage

- Records showing the names of individuals whom you are claiming Premium Tax Credit for their marketplace coverage.

- This can include copies of insurance enrollment forms, invoices, or statements from your insurance providers.

- Documentation that supports the information on Part 4, Allocation of Policy Amounts, and Part 5, Alternative Calculation for Year of Marriage, of Form 8962.

- Proof that you paid health insurance premiums.

- This includes canceled checks, paid receipts, certificates of group health plan coverage, credit card statements, or bank records.

Remember, you only have 30 days (about four and a half weeks) from the date of the notice to respond; if you need more time, contact the IRS and ask for an extension. When organizing and preparing to send your documents, make sure you include the notice stub from the original notice.

The two ways that you can send the requested documentation are via fax or mail. Whether the response is faxed or sent via mail, it is always a best practice to save a copy of the fax confirmation or, when mailing your response, to send it certified with a return receipt request. Remember, do not send your original records to the IRS. Please be sure to send only copies.

If you are a member of TaxAudit and have Audit Defense, you won’t have to deal with the notice yourself. Once you receive an IRS audit or notice, contact us immediately. You will first talk with one of our Customer Service Representatives, and this person will assign a Case Coordinator and Tax Professional to your case. These individuals will be there to support you every step of the way. Your Tax Professional, in particular, will become your representative, making phone calls, attending all meetings, and correctly submitting any requested documents on your behalf, to make sure that you do not pay the IRS more money than what you rightfully owe.

If you are not a member with TaxAudit, consider signing up for an Audit Defense membership today! Our world-class tax professionals are here to represent you, so for any future audits, you won't have to face the IRS alone.