TaxAudit Blog: Tax Question and Answers

Learn how to pay your IRS tax bill by credit card, the fees involved, and when it’s a smart option—plus alternatives for affordable tax debt relief.

Wondering how long to keep tax returns and tax records? Follow IRS record retention rules to stay organized, compliant, and audit-ready.

Learn how the adoption tax credit works, income limits, and new refundable rules under the One Big Beautiful Bill Act.

Explore how Trump Savings Accounts for Newborns work, including eligibility, contribution limits, tax rules, and long-term investment potential.

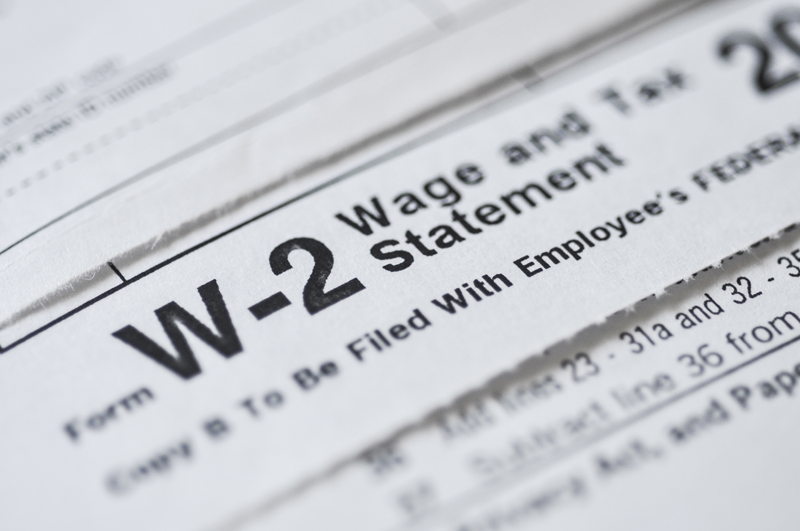

Each stock option has its own characteristics and reporting is not the same. If there is employee withholding, the employer submits to the taxing authority.

Does Hurricane Milton or Helene qualify as a diaster loss for tax purposes? What are the tax implications of natural disasters taxpayers should be aware of?

The Saver’s Tax Credit is available to qualifying taxpayers who make eligible contributions to an IRA, qualified employer retirement plan, or ABLE account.

The fastest way to check the amount of Montana estimated taxes you already paid is through the Montana Department of Revenue’s (DOR) TransAction Portal (TAP).

Per diem allowances are generally not taxable to employees. However, there are some instances in which a per diem becomes taxable. Let's look at some examples.

If my son is doing fire fighting training with no pay, is he considered to be a student for taxes? Can I get a tax credit or deduction with unpaid training?

Federal estimated tax voucher #4 list in mail. What actions should I take in filing my tax return? The IRS began accepting 2024 income tax returns on 1/27/25.

A nonrefundable tax credit lowers your tax liability but not below zero. Therefore, a nonrefundable tax credit cannot be used to create a tax refund.

Child support is not deductible for tax purposes. Child support payments are also not required to be reported as income by any person receiving them.

Whether a taxpayer files a tax return in any given state is generally based on the source of the income, but their tax home is usually where they are domiciled.

Both a tax deduction and a tax credit reduce the amount you may owe on your return, and possibly increase your refund. But how they get there is different.

You received a letter from the State of Colorado stating you do not qualify for a state sales tax refund because your return was filed after the deadline.

When shares of a limited partnership held in a SEP-IRA are completely sold are the gains subject to recapture as ordinary income as shown on the K-1 taxable?

Two siblings were listed on the title of a home with their mother. She died and the siblings sold the home and distributed the funds to the other siblings.

If you happen to miss one of your quarterly estimated tax payments, all is not lost. As soon as you remember, go ahead and make the quarterly payment late.

Kenneling a dog for work travel is considered a personal expense. However, I wonder if the answer is different if I make income from my dog?

How do I write off solar panels for rental properties when I claim as a real state professional to run a rental business?

A child who qualifies as a dependent on their parent’s tax return will need to file a tax return in certain situations. Let's explore when they need to file.

My mom passed away about a year ago, and I inherited two IRAs. Can I roll over one of the IRAs into the other inherited IRA if it is done by direct transfer?

Can you claim a depreciation deduction for Section 1250 residential property in the year the property is sold? When it comes to taxes, details matter.

My minor daughter was a beneficiary for her uncle's savings account. Does she need to report it as income? Are there tax implications if she gifts the money?

A tax refund offset can indeed be reversed – but it is not a simple matter. It would be much better for taxpayers to prevent the offset from happening.

I'm inheriting $44,000 from my father's house being sold in New York. I just want to know how much tax, if any, would I have to pay in South Carolina. Thank You

My brother's wife died and he was left with the house. He gifted (no exchange of money) me the house and I sold it. How do I report capital gains?

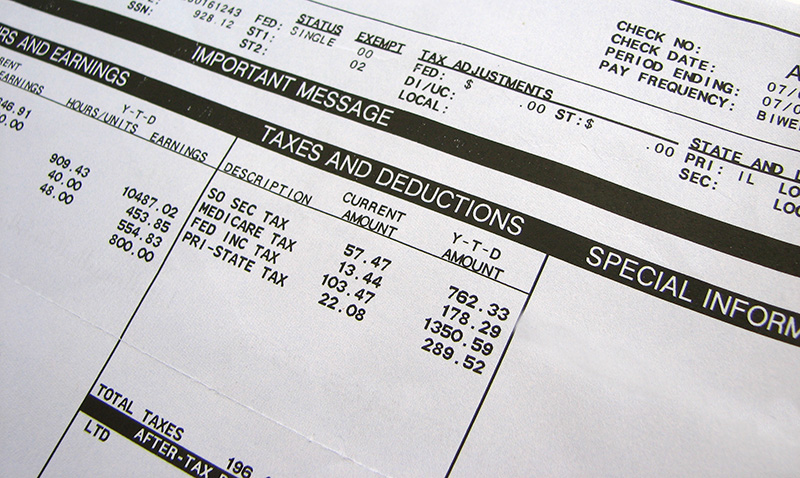

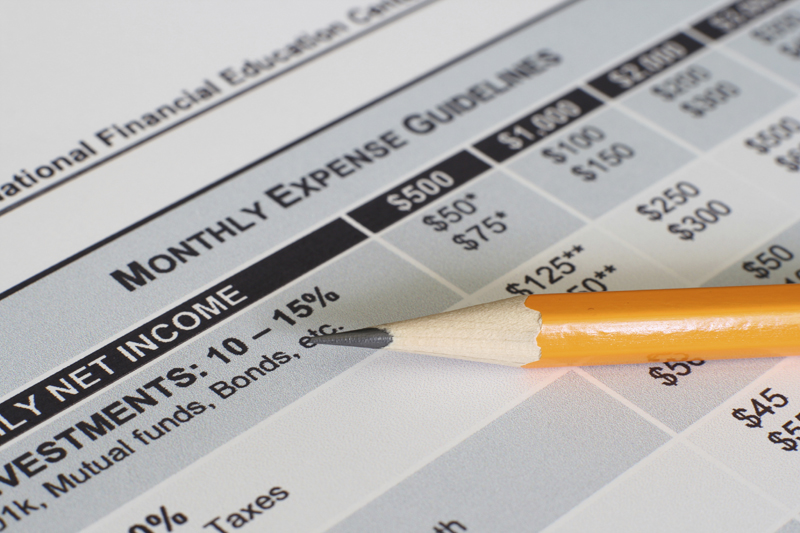

The biggest chunk that will be deducted from your paycheck is most likely taxes, both federal and state. Federal taxes include income tax and FICA.

While some legal settlements can be excluded, either in full or partially, the vast majority of legal settlements will be considered to be taxable income.

Writing off the purchase of solar panels for your sole proprietorship can be complicated, but we will try to highlight some of the options for you to consider.

To claim a dependent on your tax return (and all the credits that come with that dependent), your child must meet a set of requirements.

You cannot claim yourself as a dependent. It can be helpful for you find out who actually can claim you as a dependent and whether or not they intend to do so.

Your son does not need to report or pay tax on the $70,000 you gifted him from the inheritance your wife received from her mother’s probate! Let's explore more.

If the IRS applies your payment to the wrong tax year, they will generally fix the issue once they know the problem. Let's learn more.

With TurboTax Audit Defense if you receive a letter from the IRS or state tax agency, simply contact TaxAudit that you’ve received IRS correspondence for help.

If you have audit protection, you don’t have to panic when you get a letter from the IRS. Instead, you can call TaxAudit right away, so we can step in to help!

First, the essential concept to understand is that cryptocurrency is not treated as money for U.S. federal income tax purposes but is treated as property.

What is Audit Defense? And is it worth it? Let's provide some clarity about exactly what you are getting when you purchase Audit Defense from TurboTax!

You’d like to know if you can file an amended tax return to claim the Recovery Rebate Credit if you did not receive the economic stimulus payment.

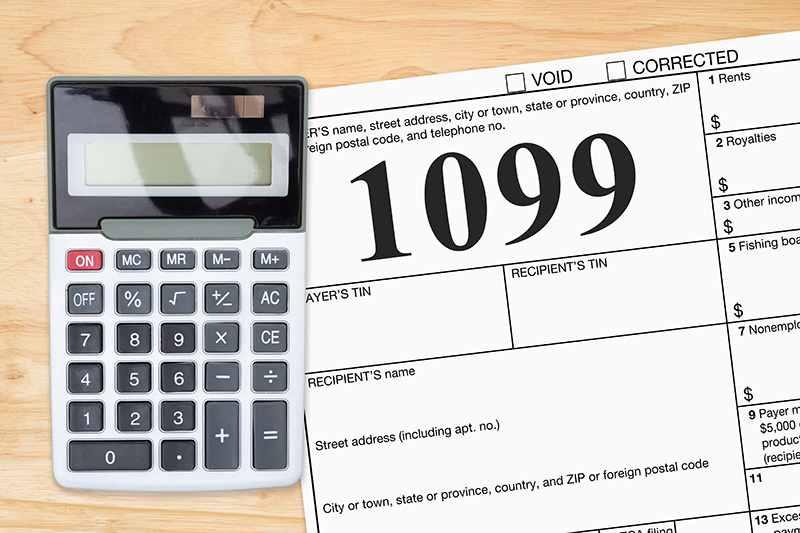

I received 3 1099 forms - 1 for interest and two from houses which were sold in the months after his passing. Is the estate required to file a return?

If the IRS is taking your refund, sometimes you need a qualified tax professional who understands IRS collection procedures to intercede on your behalf.

When you owe money to the IRS, they can take a variety of actions against you to collect the balance due. You can repay the IRS debt using unemployment checks.

Father died 30 years ago. Stepmother just sold house and children split father's portion of sale (after filing of an affidavit of heirship). Do we owe taxes?

The 2021 expense limit for this credit is $8,000 for one qualifying child, and $16,000 for two or more qualifying children. The credit is a % of those expenses.

You asked if you could deduct tuition expenses for enrollment in a graduate degree program as a job-related education expense on federal and NY state taxes.

You asked whether the mortgage payments that your ex paid on the house you received in the divorce are taxable. This answer depends on your specific situation.

To know if your home inheritance is taxable income you will need to start by figuring out what your step up in basis is - the property value when someone dies.

My fiancé has recently been incarcerated. Prior to arrest he filled on pandemic unemployment, but I did not. How should I file taxes this year?

To claim a child for this credit, the child has to meet several tests. Biology isn’t a disqualifier in claiming dependents, but other factors must be met.

Yes! Audit Defense is worth it. Not only do audit defense members get help with IRS and state correspondences – there are a variety of other benefits.

Estimated tax payments are additional payments that taxpayers may make on a quarterly basis to cover any additional taxes that may be due.

As a military member do you have the same tax filing deadline as U.S. citizens? Are there tax filing extensions available for deployed members of the services?

You might be questioning if TurboTax Audit Defense is any good as you file your tax return through TurboTax. Yes, you want audit defense and it is worth it!

One of the frequently asked questions we get from our customers is, “Can I buy audit defense for tax returns filed in previous years?” The short answer is: Yes!

New Jersey, NJ imposes a tax on the beneficiaries of estates. The tax return requires the tax be paid by the estate on behalf of all the estate’s beneficiaries.

Whether you will be taxed on the money received from a trust will depend on the type of trust and the instructions laid out, the assets titled, and more.

You are responsible for paying the taxes on the amount realized in the sale. The buyer is generally not required to withhold income taxes on the proceeds.

Yes, TaxAudit is a good company that has been providing clients with A+ rated tax representation services since 1988. TaxAudit truly cares for its clients.

If you are under audit, it is acceptable to submit your current tax return. Just be mindful that you may have to amend it once the previous year's audit closes.

My wife drives to transport our granddaughter to our house to watch for the day. Is this to-and-from mileage deductible as a job-related expense?

I had investment capital losses of over 17,000 dollars, yet my Schedule D is only allowing a $3,000 loss. Can I take the additional losses in future tax years?

I inherited a property located in foreign country from non-US relative, do I need to file 1099-S? I did not receive 1099-S since the property is not in USA.

Your audit defense membership with TaxAudit provides expert representation for each tax return year for which you have a membership.

For IRA contribution purposes, certain third-party sick pay does qualify as compensation. But, there are instances where it is not considered compensation.

Why doesn't my IRS account show I owe money if I received a Notice of Deficiency? A Notice of Deficiency represents an estimated amount due and isn't finalized.

When you inherit real property, like a home, then for tax purposes the beneficiaries receive what is called a “stepped-up” basis.

When you are relieved of debt through the cancellation of debt, that amount is considered to be income to you, even though you did not receive cash.

The IRS has not issued guidance on whether an EIP distribution will be placed on hold if a taxpayer’s 2020 return is audited to question dependents.

Generally, as long as the incarcerated person is a US citizen (or resident alien), has a valid SSN, and is not claimed as a dependent, they may qualify.

If I haven't worked in a couple of years and didn't file taxes or get the first stimulus check, then where do I start or how do I file?

My grandson is in my custody and his mom allowed another person to carry him on taxes..my taxes were rejected. What should I do next?

It is not uncommon for state wages to be higher than their federal wages. This alone generally should not trigger a return to be rejected for e-filing.

If the income items on the Schedule K-1 are sufficiently large, they will generate additional taxes due on your return. You will need to amend your tax return.

Having custody does not determine who can claim a child as a dependent. The IRS will look to who can prove the child lived with them most of the year.

There are a bevy of options available to taxpayers who want to make a payment to the IRS online. The IRS even has an app for that!

Replacing an entire roof will increase the cost basis of the home. However, any costs paid or reimbursed by an insurance are not added to the home's basis.

When a taxpayer does not file their income tax return or ignores an audit notice, the IRS makes tax assessments based on info received from third parties.

Generally, a “regular” limited partnership does not throw off any income that would make it currently taxable while it is inside an IRA.

Consider the potential risks and benefits before adding an adult child or caregiver as an owner of your home, bank account, credit card, or any other asset.

Yes, TaxAudit, the exclusive provider of TurboTax Audit Defense, represents members through the completion of any state or federal income tax audit.

TaxAudit is the exclusive provider of TurboTax® Audit Defense. The phone number for TaxAudit’s customer service department is 877.829.9695.

The answer for most states is no. However, 6 states allow some form of this tax break (AL, IA, LA, MO, MT, OR), but only AL, IA, and LA allow a full deduction.

Before your audit defense certificate can be sent via email, TurboTax must first notify TaxAudit of the audit defense purchase. This usually takes 1 to 6 days.

For 2018 taxes I did not add my 1099. The IRS is saying I owe. How can I remedy this? I have the 1099 ready to add.

I am a mobile notary Signing Agent. When doing quarterly payments, would I claim pay on the month I do appt. or when I get paid?

Generally, when you inherit money it is tax-free to you as a beneficiary. However, like so much in tax law, the answer to this question is “it depends.”

Generally, Married Filing Jointly is more beneficial as some deductions are not allowed if you file Married Filing Separate. You can use tax software to compare

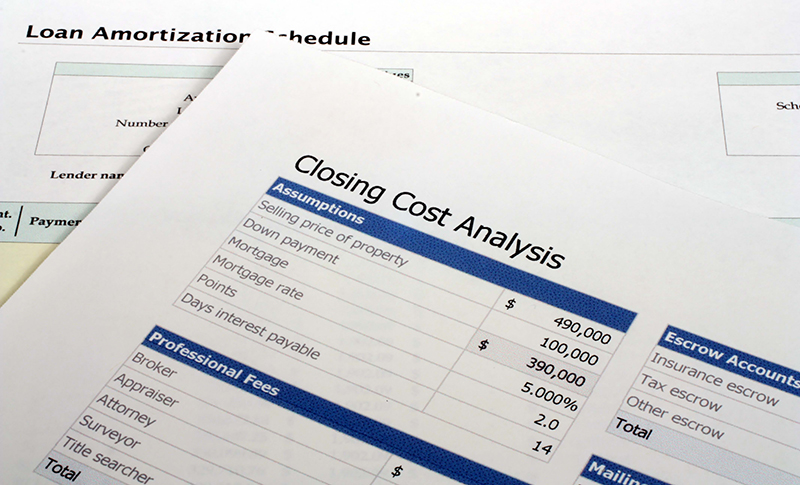

Many people try to guess the amount of their closing costs and use that for their taxes. If they are ever audited, this would not likely work out well for them.

Tax Topic 151 means the Department of Treasury will be taking your refund or part of your refund to pay for something that has been reported that you owe.

From a tax standpoint, a relationship that is established by marriage, such as your relationship with your mother-in-law, does not end with divorce.

Yes, kids may have to pay taxes. No matter a person's age, if they have income that exceed certain IRS thresholds, the income should be reported.

401k loans aren't reported on your federal tax return unless you default on them. Then it becomes a distribution and subject to the rules of early withdrawal.

Inmates are responsible for filing taxes. While you can certainly help your boyfriend file his taxes, you can’t sign and submit the return on his behalf.

The IRS’s “Where’s My Refund” app should be your first your first destination to find out the status of your refund.

A bonus is considered a supplemental wage payment and is therefore subject to slightly different withholding guidelines under federal rules.

The first thing to do is to check every name and Social Security number listed on the return with what is listed on their Social Security cards.

While increasing allowances leaves you with more available funds throughout the year, it will have a rippling effect and your tax refund will decrease.

Returns are being processed, and refunds are being issued. Things seem back to normal.

Below is a list of misconceptions and examples of misinformation taxpayers may encounter during the upcoming tax season.

For the American Opportunity Credit, a student is required to be in pursuit of a degree or recognized education credential and be enrolled at least half-time

When more than one person wants to claim a child on their tax return, sorting it out becomes complicated. Not only are there five tests to meet for a child...

Lottery earnings are generally reported on Form W-2G, taxed as ordinary income, and expected to be reported as “other income” on the federal tax return.

When determining the deduction for a home office, there are two different methods to choose from: Actual expenses and the simplified method.

The IRS general rules for keeping tax records and returns is you must keep them for the period of time in which the IRS can audit you and assess additional tax.

The IRS is currently offering this cash payment alternative at participating 7-Eleven stores in 34 states.

The Child and Dependent Care Credit is available to help offset some expenses of childcare or daycare costs.

If my ex-wife lives with me and I provided more than half of her financial support will I be considered single status or head of household?

I’m legally married and live with my spouse. We file our taxes separately. Can I file as head of household while he files as married filing separately?

I have a question about a head of household. My ex-husband passed away, which left his mother needing someone to care for her. I took her into my home…

There are only two months left in the year. What can I do now to avoid paying a big tax liablity on my Schedule C business next year?

The Cadillac tax has zero to do with automobiles and everything to do with health care.

Starbucks? Coffee beans? Lattes? What do they have to do with taxes? Don’t worry, we will get to that! But first, let’s discuss your Golden Years again...

Are disability payments taxable? This is a good question, but there is no correct general "yes" or "no" answer.

Should I include notary feeds on my tax return?

What is the best option are for getting rid of an old vehicle? Should I donate it for the auto valuation guide value of $3,000 or sell it now for $1,500?

What do I do with a stepdaughter who doesn't live with us? She is in college and lives with her mom. How do I list that? My husband pays child support.

I am a policy and procedure writer for a company. Due to my long commute, my boss lets me work from home one day a week. Can I write off my home office?

How long does it take to get my refund if I e-filed my taxes? It seems like I should have received it by now.

Crowdfunding is a popular way to raise funds for businesses, charities and individuals. It occurs when someone asks others to contribute to their idea or cause.

How many miles can I claim on my tax return when driving for work?

filed my tax return, and then a W-2 came in the mail for a job I worked earlier this year that I had forgotten about. How do I file this?

I am considering buying Gold Bullion. I am 68 and do not plan on using an IRA of any kind for this. What are the tax implications of buying gold?

The Earned Income Tax Credit is available to workers who earn $52,427 or less from wages or self–employment.

Is there a threshold as to when a married couple filing jointly would fall under the AMT? There is not a threshold, per se. AMT, or Alternative Minimum Tax...

I’ve never been married and I have no children. I’ve been successful in my career and have some money saved. I want to give my six nieces and nephews $20,000

My husband passed in February of this 2104. We have always filed a joint return. What do I need to do this year?

I have a daughter who is eligible for the American Opportunity Tax Credit of $2,500.00. Can she also use the Lifetime Educational Tax Credit of $4,000.00?

We have an off-shore account, set up in 1998 when they weren't reportable. But now under the Foreign Account Tax Compliance Act, the accounts are reportable.

I took care of my three nieces and a nephew (all under 17 years of age) up until the end of last month, August 28, 2014, to be exact. I claimed these kids...

Uncle Sam expects to see that Fair Market Value (FMV) listed on your tax return for that tax year as income.

If I'm going to do home repairs, such as a roof and heating, which will cost about $15,000, would it be better to take out a home equity loan to pay for it or..

If you made an mistake on your taxes or omitted required information, such as a late-received W-2 or K-1, you can file an amended return on Form 1040X.

If you are a member of the U.S. Armed Forces, there are tax breaks written just for you. Merchant Mariners and American Red Cross employees do not qualify...

We have been asked to build some basic boxes to be used as a stage for a company. They plan to pay us but are not placing us on their payroll as employees.

Tired of feeling like the government is taking your last penny? Having trouble making ends meet? There is a solution – provided you are willing to move.

For several years, National Taxpayer Advocate Nina Olson has been arguing for the simplification and codification of taxpayer rights and responsibilities.

Taxpayers who must pay alimony to a former spouse may deduct it from his/her tax return as an adjustment to income.

If you have a dedicated credit card for your business, can you use the statement as the receipt for your business entertainment, meals, travel, etc.?

While we call it the “Jock Tax,” it really is a tax that does affect a variety of people, but we are focusing on the NBA because of the extensive travel habits.

I hate allowing the government an interest free loan. This year I had a penalty for owing too much at the end of the year. So my question is: how…

My son was arrested in December of 2012 and spent the entire year of 2013 in jail awaiting trial. During that year I paid his attorney fees, car payments...

You got your return filed on time and you’ve got a nice big refund coming. But the funds don’t show up in your bank account when you expected them to. Now what?

My two children live with my ex. He is the custodial parent but we have joint custody. I pay child support and they come over to my house almost every weekend.

Household employers: Did you hire someone to care for your children in your home? Do you have a gardener, a handyman, or a chauffeur?

I lived with my younger cousins, ages 11 and 4, in 2013 except for about 2 months when I stayed with my father while he was sick. I provided more than...

In order to qualify for an Earned Income Tax Credit (EITC) of up to $6,044, you must first meet these two qualifications: You must have earned income...

I’m sure you remember when Susan Boyle became an overnight web sensation. Since then, thousands of hopeful musicians, writers, artists, and dancers...

Taxes! Usually, this word creates a strong emotive reaction. We older people tend to not remember the days back when we first filed our very first 1040 EZ.