IRS CP87A | You Need to Make Sure Someone Is Your Dependent

May 09, 2024 by Charla Suaste

As children and young adults, opening up the mail was always an exciting endeavor. Every time you opened the mailbox, you never knew what kind of surprises might await you! You could get a letter from a friend or your grandmother, a surprise package – heck, even a postcard from the dentist seemed like a thrill! The mailbox was once a lockbox of mysteries, waiting to be discovered anew each day.

Of course, as we grew older, that excitement began to wane – no longer were the days when we might get a surprise card from a friend. Rather, we open the mailbox to find bills, solicitations, and an abundance of coupons we’ll never probably sift through. Every day, though, taxpayers do get a surprise letter in the mail – although it’s often not one anyone wants to receive: a letter from the IRS.

One of the letters we’re going to talk about today is an IRS CP87A notice.

If you’re reading this, it’s likely you’ve received one of these letters and are wondering what it means and what you should do to resolve it.

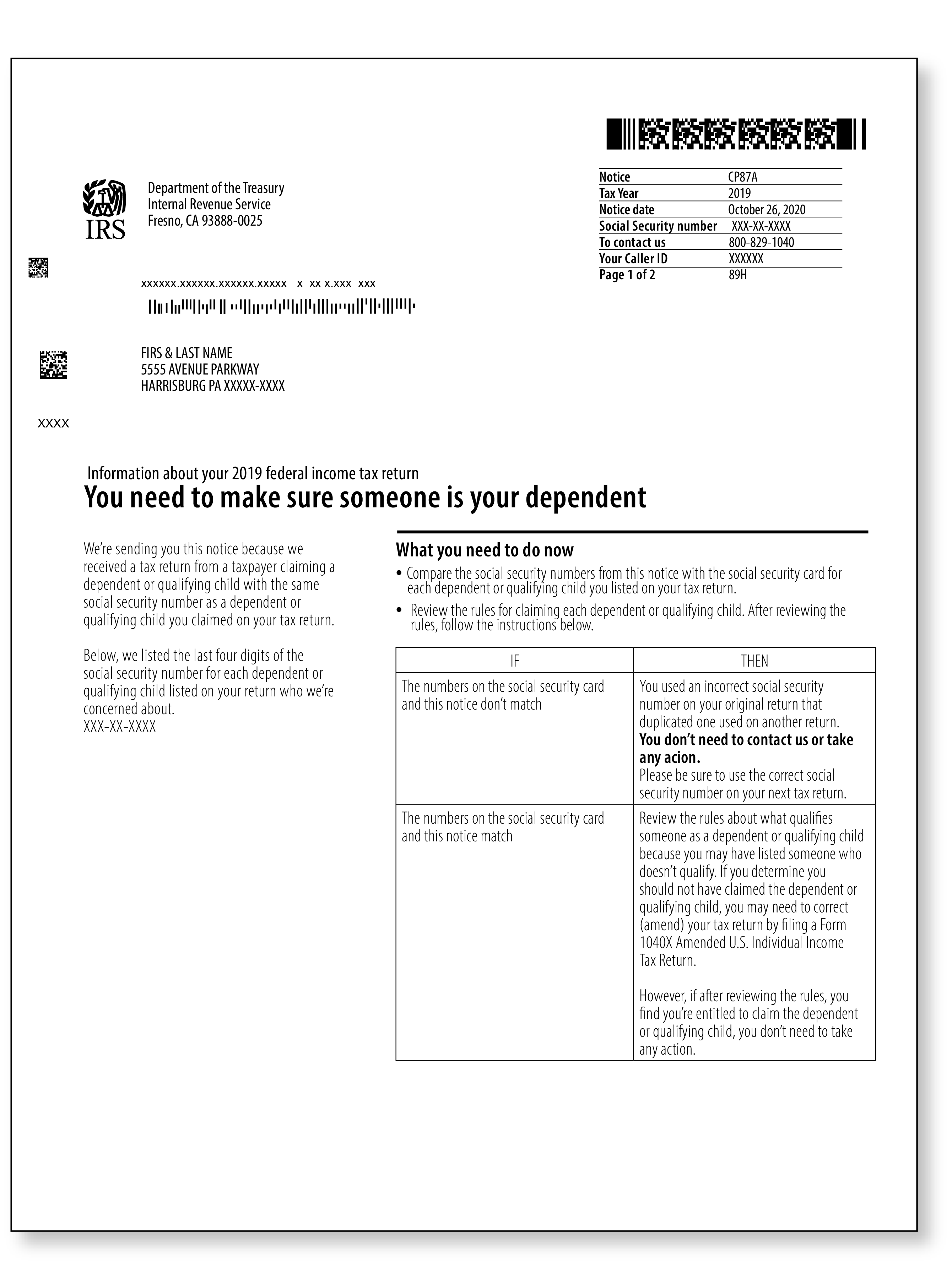

Let’s jump in and talk about it. Below is a copy of what an IRS CP87A looks like.

What is this notice all about?

According to the IRS records, someone else filed a tax return and claimed the same dependent or qualifying child that you claimed on your tax return. This notice is intended to inform you that this occurred and ask you to confirm that you did, indeed, correctly claim the dependent or qualifying child.

What should I do next?

The next thing to do is review the corresponding filed tax return and look at the social security numbers to verify they were entered correctly. It is possible that, during the filing process, numbers were accidentally transposed.

If any of the social security numbers listed on the return are incorrect, you will need to file an amended tax return with the correct information. If you used TurboTax to file the return, you can easily do this through their software. If a tax preparer was the one to file your return, make sure to reach out to them so they can look at the notice and tax return and assist you with an amendment.

If, upon review of the tax return, the social security numbers were all entered accurately, the next thing you will want to do is familiarize yourself with IRS Publication 501, Dependents, Standard Deduction, and Filing Information. This is the publication you should be using when preparing your tax return to verify that you are entitled to claim certain dependents or qualifying children.

Again, if you discover you missed something and you are not entitled to claim certain dependents, you will need to file an amended return.

If, after reviewing both the notice, tax return, and Publication 501, you believe you are still entitled to claim those particular dependents, there is nothing you need to do at this time. However, moving forward, it is important to be prudent about keeping meticulous records for any dependents you claim so that you can be prepared in the event of a future audit.

Something final that is important to note: If you did not claim the qualifying child or dependent listed on the notice, you will want to contact the IRS using the number in the top right-hand corner of the notice. It is possible that someone else used your social security number when filing, and you will want to notify the IRS ASAP. You can also use the Identify Theft Central landing page on the IRS webpage for more information.

Is there anything else I should know?

Yes! If you have an Audit Defense Membership with TaxAudit for the tax year in question, call us as soon as possible so we can help! One of our world-class Tax Professionals will review your documents and verify what next steps you should take, if any. Their goal is to help take the guesswork out of your next steps and make sure that you are prepared in the event an audit should occur.

However, if you are not a member with TaxAudit, now is the time to sign up! In the event of any future audits or notices, our team works with the IRS on your behalf, so you never have to face them alone and never pay more tax than what you rightfully owe.

If you want more information, would like to view our member testimonials, or are ready to get signed up, click here to get started!