Claiming a Child Tax Credit? You May Need a Paternity Test

April 28, 2023 by Eric Erhardt, EA

Congratulations on the new bundle of joy in your lives. As new parents, there are thousands of issues you must anticipate in keeping your child safe and well-cared for – and the tax benefits available to parents can help make ends meet.

However, encountering issues with one of these tax benefits, such as the Child Tax Credit (CTC), can potentially derail a family’s budget and cause financial hardship.

What is the CTC, you ask?

The Child Tax Credit is a federal credit given to qualifying individual taxpayers who have children under certain limitations. There is a refundable and nonrefundable component, so the Child Tax Credit can help lower the amount of taxes you owe, and it can result in a tax refund.

To qualify for the Child Tax Credit, you and your child must meet the following requirements:

- Your child is under age 17 at the end of the year.

- The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece, or nephew). Keep in mind that the taxpayer must be older than the dependent being claimed.

- You are the one claiming the child as a dependent.

- The child did not provide more than half of their own support for the year. This is also known as the “support test.”

- The child lived with you for more than half the year.

- The child has a Social Security number by the due date of the originally filed return, including extensions. Taxpayers may not file their return without the child’s Social Security number and later claim the Child Tax Credit by filing an amended return that includes the child’s Social Security number.

- Your child has not filed a joint return with their spouse for the tax year, except for the purpose of claiming a refund on withholdings or estimated taxes paid.

- Your child is a U.S. citizen, U.S. national, or U.S. resident alien.

- Your annual income is not more than $200,000 ($400,000 if filing a joint return).

How will you know if you qualify to claim the Child Tax Credit?

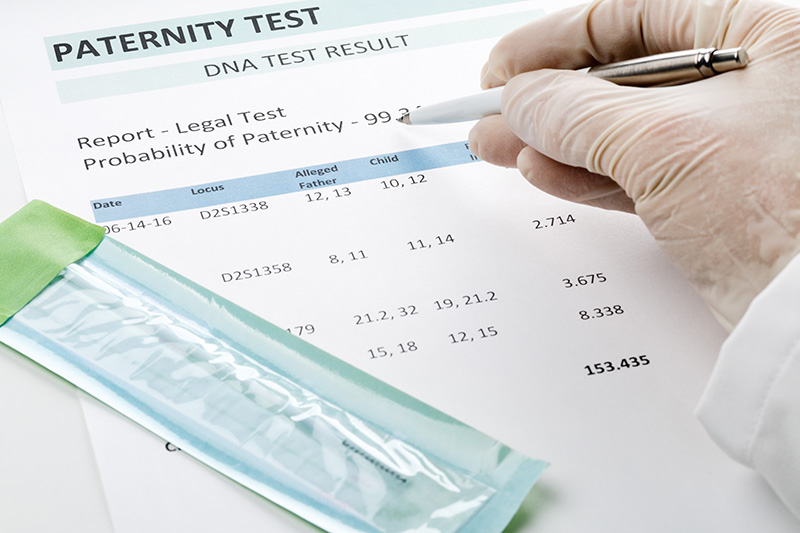

Most of the requirements to claim the Child Tax Credit are simple. For example, it is generally easy to determine your child’s age, citizenship, Social Security number, and marital status. However, one of the requirements that can sometimes be problematic is proving your relationship with your child. The IRS accepts the child’s birth certificate to prove your relationship to your child. However, not all states require the father’s name to be listed on the child’s birth certificate. What if your name is not on the birth certificate? How are you going to prove you are related to your child? This may be time to consider a paternity test.

The IRS will accept paternity test results only if the DNA sample collection and mailing are supervised by an approved witness. This is to ensure the chain of custody is maintained throughout the procedure. The IRS will not accept results from an at-home test. Check your area for DNA testing centers near you. If the DNA sample collection and mailing are supervised, and the chain of custody is maintained throughout the process, the IRS will accept the results of the paternity test, and you have proven your relationship to your child.

If the IRS requests you to prove you qualify, you must be able to provide documents verifying all the requirements listed above. If you cannot prove all the requirements, you may not qualify for the Child Tax Credit. The IRS can also disqualify you from claiming the Child Tax Credit for two years if your claim is denied due to reckless or intentional disregard of the Child Tax Credit requirements. The disqualification is increased to ten years for claims denied due to fraud. The IRS could also charge penalties for denied claims of the Child Tax Credit.

If you are facing an audit, know that you are not alone. The tax professionals at TaxAudit have the knowledge and expertise to represent you through the audit process. For more information about our representation services and prepaid audit defense membership, please click here.