What address should I use to mail my tax returns?

April 22, 2021 by Rhonda D. Guillory, EA

My son is 17 years old and filed his 2020 taxes.. I don't know where to send the state and federal taxes to can you please give me an address?

Melissa, Oklahoma

Dear Melissa,

Thanks for your question, and congratulations on your son completing his 2020 tax return. The good news is that your son may have the option to file his tax return electronically if he used tax preparation software. Please be sure that both the federal and state tax return are filed when choosing to file electronically and to save a copy of the returns for your records.

As you complete a final review of the tax return before filing,I suggest you confirm that your son has answered the dependency question correctly. If your son was still a dependent in 2020, the “Someone can claim you as a dependent” box should likely be checked. Confirming this entry can reduce confusion for parents and dependent down the road.

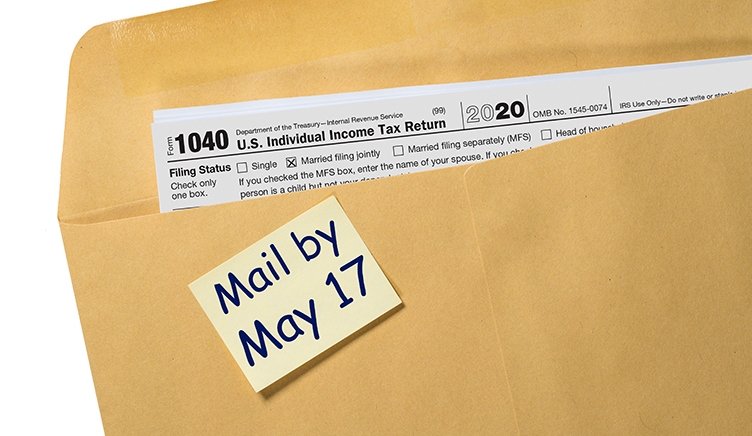

The IRS encourages electronic filing to avoid processing delays. However, if electronic filing is not an option or desirable, you may find the address to mail your federal tax return by selecting your state on the IRS website: https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment. Due to an extension, the deadline to file your 2020 federal tax return is May 17, 2021.

Oklahoma’s 2020 tax filing and payment deadline has also been extended, and the deadline is June 15, 2021. The mailing address for individual Oklahoma state tax returns is:

Oklahoma Tax Commission

Post Office Box 26800

Oklahoma City, OK 73126-0800

Additional mailing addresses may be found on the Oklahoma Tax Commission website: https://www.ok.gov/tax/documents/MalingAddresses.pdf.

Best wishes,

Rhonda Guillory