Can I Deduct IRA Contributions on my Taxes?

October 27, 2023 by Lisa Brugman, EA

That is a great question. Each person’s situation will have unique facts and circumstances, so well…it depends.

Let’s discuss some general scenarios and you can see if any of these apply to you. You may also want to reference IRS Pub 590-A and FAQs Regarding IRAs to see what the IRS says about this issue.

First and foremost, it is important to remember that the deductibility of an IRA contribution is affected by your filing status and your Modified Adjusted Gross Income (MAGI) and is subject to limits depending on your circumstances. As a taxpayer, you may want to consider the following:

Are you covered by an employer retirement plan like a 401k or 403b?

If yes, then your IRA contribution deduction on your 2022 tax return may be limited by your Modified Adjusted Gross Income (MAGI) as follows:

- If you are Single for tax purposes and file Single or Head of Household, your deductibility begins to phase out at $68,000 and is completely gone at $78,000.

- If you file Married Filing Jointly (MFJ) or Widower and both you and your spouse are covered by an employer retirement plan, your deductibility begins to phase out at $109,000 and is completely gone at $129,000.

- If you file MFJ or Widower and only one spouse is covered by an employer retirement plan, your deductibility begins to phase out at $204,000 and is completely gone at $214,000.

- If you file Married Filing Separately, your IRA deductibility is partial for income up to $9,999, and there is no deduction if your MAGI is $10,000 or more.

There are limits to how much you can contribute to an IRA/Roth IRA each year.

For 2022, you can contribute up to $6,000 per person per tax year. It will be $6,500 in 2023. Taxpayers who are age 50 and older can make annual catch-up contributions. For IRA/Roth IRA, the catch-up is $1,000 per taxpayer per year.

Now that we’ve reviewed the basics, let’s look at some general examples to see how this works.

Example 1: Jack and Jill

Jack and Jill are both under 50. They file Married Filing Jointly and they both participate in their employer’s retirement plans, which could include a 401k or 403b. In 2022, their MAGI was $100,000.

Jack contributes the maximum amount to his employer’s retirement plan by contributing $20,500 in 2022, through his paycheck.Can Jack contribute to an IRA and then take a tax deduction for it?

- Yes and no. Jack has maxed out the elective deferral contribution limit of $20,500 for 2022, but he can still contribute to an IRA in this case. However, he cannot deduct his IRA contributions on his tax return.

- If Jack makes any IRA contribution (up to the $6,000 limit), he will have to file Form 8606 advising the IRS of the non-deductible contribution to his IRA.

- Form 8606 is the method by which Jack will track how much money in non-deductible contributions he made to his IRA. This form documents his cost basis in the IRA. The cost basis is not taxed again when Jack takes distributions in retirement.

Jill contributes $2,500 to her employer’s retirement plan. Can Jill contribute to an IRA and take a tax deduction for it?

- Yes. In this case, Jill has not maxed out her elective deferral contribution. She can contribute up to the maximum of $6,000 to her IRA. Additionally, Jack and Jill’s MAGI is under the limit so Jill can deduct up to the maximum contribution to an IRA of $6,000.

For 2022, each taxpayer under age 50 (if participating in their employer plan) can contribute to their employer plan and IRA (up to the max of $6,000) for a total contribution of $20,500 max. These contributions are pre-tax (through payroll deduction) and/or deductible on their tax return subject to MAGI limitations.

- If Jack contributed the maximum amount to his employer plan of $20,500 pre-tax through his paycheck, he could still contribute $6,000 to his IRA, but he COULD NOT deduct it on his tax return because he has already maxed out his possible pre-tax retirement deduction. The $6,000 would be a non-deductible contribution and would necessitate his filing of Form 8606, as described above.

- If Jack and/or Jill were age 50 or older, they could make a catch-up contribution of $1,000 each to their IRAs. Catch-up contributions do not count towards the taxpayer’s elective deferral contribution limit but are in addition to them.

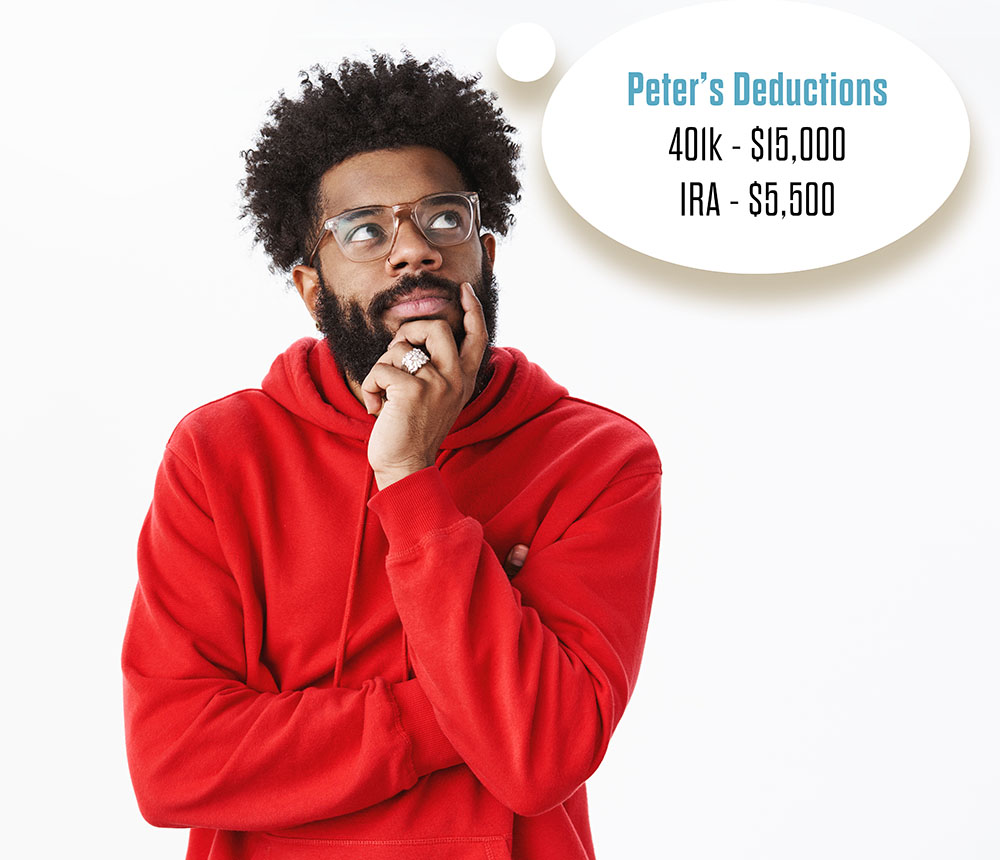

Example 2: Peter

Peter is single, under age 50, and makes $65,000 MAGI.

Peter has contributed $15,000 to his employer’s retirement plan. So, how much can Peter contribute to his IRA? And is that amount deductible?

- Peter can contribute up to $6,000 to his IRA, but only $5,500 can be deducted because of the elective deferral contribution limit of $20,500 in 2022.

- Since his MAGI is under the limit, he can deduct $5,500 on his tax return. The remaining $500 contribution should be reported as a non-deductible contribution to an IRA on Form 8606.

What if Peter is over 50 and contributes the maximum amount to his IRA of $7,000? Can he do this? And is it deductible?

- In this case, Peter is still only eligible to deduct $5,500 for a tax deduction because he has already contributed $15,000 to his employer retirement plan; with $5,500 of his IRA contribution, he maxes out his elective deferral contribution of $20,500 for 2022.

- What happens to the extra $1,500? Peter can claim the $1,500 as a non-deductible IRA contribution and this would necessitate the filing of Form 8606.

What if you (and your spouse, if Married Filing Jointly) are not covered by retirement plans with your employers but do have earned income? Can you contribute and/or deduct the IRA contributions? Let’s look at example 3 below.

Example 3: Janet and Bob

Janet and Bob file MFJ and are not covered by employer retirement plans.

Can Janet and Bob contribute to an IRA? If so, how much, and is it deductible?

- Yes. Janet and Bob can each contribute and deduct their IRA contributions on their tax return up to the amount of their taxable compensation.

- Janet, who is under 50, can contribute and deduct up to $6,000 for 2022. Bob, who is over 50, can contribute the $6,000 plus a $1,000 catch-up, and deduct up to $7,000 for 2022.

Note here that, since there is no coverage from an employer retirement plan, the MAGI phase-out limit doesn’t apply. Janet and Bob can deduct their entire contributions, regardless of MAGI, on their tax return for 2022.

Some final things to note about contributing to a Roth IRA

- Though this contribution counts towards your elective deferral contribution limit (just like the Traditional IRA), the contributions are never deductible as they are after-tax contributions by nature.

- Roth IRAs are always subject to MAGI limits, whether you contribute to an employer retirement plan or not.

- The elective deferral contribution limit for tax year 2023 will be $22,500.

- For tax year 2023, IRA/Roth IRA contribution limits will be $6,500 for taxpayers under 50, and $7,500 for taxpayers over 50.

- Make sure you check out FAQs Regarding IRAs on the IRS website each year to verify the contribution and MAGI limits.

To summarize, your IRA contribution may be deductible depending on your personal facts and circumstances, including possible MAGI limitations.

If you receive a tax agency letter questioning your deduction, remember that TaxAudit has a team of tax professionals who are always ready to assist you. You can learn more about our audit defense service by clicking here.