IRS Debt: Statute of Limitations on Collection of Back Taxes

June 07, 2022 by Steve Banner, EA, MBA

The subject of this article reminds me of an old joke going back to the early days of stand-up comics offering relationship advice on TV tonight shows:

“Don’t worry if you make a mistake in your life, because sooner or later everyone will forget about it. Everyone, that is, except your mother-in-law and the IRS.”

I can’t speak for your particular mother-in-law, but I can tell you something about the IRS and how well they remember things like the amount of unpaid taxes you owe. Although the IRS has detailed records on your tax situation, they do not have the right to chase you forever to collect your unpaid taxes. Instead, the IRS has only a fixed amount of time in which to try to get you to pay up. This fixed period is known as the “statute of limitations,” which generally means the IRS has up to 10 years to collect taxes from you. Once that 10-year period comes to an end, the IRS can no longer collect on that debt. In fact, thousands of taxpayers every year are relieved from the burden of their tax debt by the expiration of the statute of limitations in their case.

Although this 10-year rule sounds quite simple, it’s important to understand how the start and end dates are calculated. The day the IRS officially assesses the tax on your return is the date that the statute of limitations begins. For example, although most taxpayers who owe taxes will pay the balance due when they file their tax return, others will receive a bill from the IRS if they do not pay in full by the tax due date of their return. This bill serves as written notice of the amount they owe. The date on this bill generally provides an indication of the start date of the ten-year limitations period.

Now, you might reflect on what I have just said and think that if you don’t file a tax return at all, then there will be no bill, and thus no 10-year collection period. But what you need to know is that if you don’t file a return yourself, the IRS can file a substitute return on your behalf and then start the collection period. In that case, you would need to contact the IRS to find out the end date of your 10-year statute of limitations. This end date is known as the CSED (Collection Statute Expiration Date).

Taxpayers who find themselves in a position where they owe a tax bill they are unable to pay immediately will be subject to collection efforts by the IRS up until the CSED. After this date arrives, the IRS must stop its collection efforts. It is important, therefore, for taxpayers to know the exact CSED that applies to their case – normally 10 years after the issue of their original tax bill, as you have already seen.

But any time after it starts, the 10-year clock can be stopped temporarily for a variety of reasons such as:

- Bankruptcy filing

- Offer in Compromise filing

- Appeals filing

- Request for innocent spouse relief

- Being out of the country continuously for at least 6 months

For example, if a taxpayer files for bankruptcy, the clock is stopped for the period of the bankruptcy case, plus six months. Actions such as these can make it difficult for both taxpayers and the IRS to keep track of the true CSED in each case, causing complications for all parties concerned.

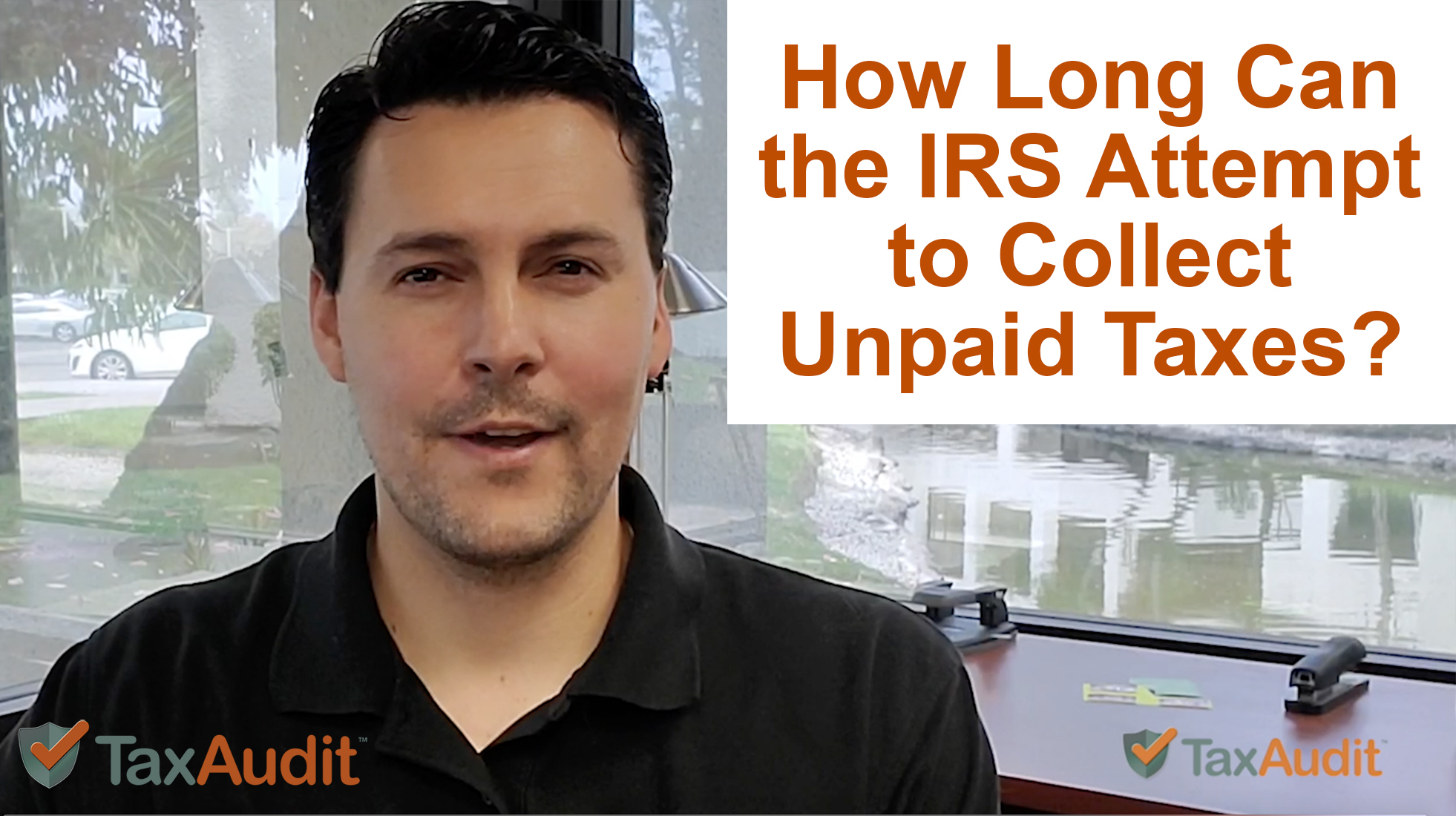

Fortunately, the tax law offers a number of different options for taxpayers to deal with their outstanding tax bills – but it can be very difficult to find your way through such situations alone. TaxAudit’s Debt Relief service offers free consultations and individual advice to help you understand your choices. This short video also features one of our tax attorneys giving a further explanation of the Statute of Limitations and its importance in resolving individual tax debt collection cases.

And although TaxAudit can help you when it comes to IRS problems, I’m afraid you’re on your own when it comes to dealing with family members who have long memories!