How much taxes are deducted from my paycheck?

March, 07 2023 by Karen Thomas-Brandt, EA

Getting your first job is such an exciting moment in your life. Second only to getting that first paycheck…until you open the envelope and realize your paycheck is much less than you thought it would be. Why? You knew taxes would be withheld, but why so much? It’s got to be a mistake, right? Usually, it isn’t.

Gross wages vs. net wages

First, let’s talk about the difference between “how much you earned” and “how much you get to take home.” The first amount, how much you earned, is called gross wages. This is the amount you earned before anything is deducted. The second amount, how much you get to take home, is called net wages. This is the amount you earned less all deductions. Sometimes the difference between the two can be rather startling. So, what makes up that difference?

What are the deductions?

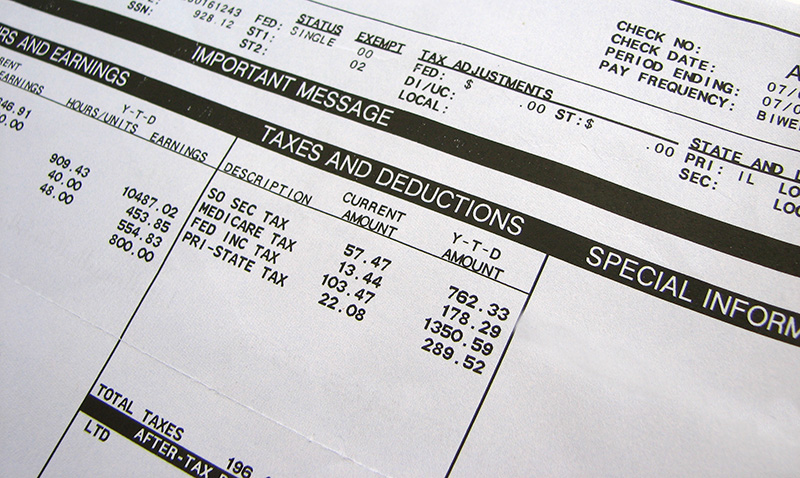

The biggest chunk that will be deducted from your paycheck is most likely taxes, both federal and state. Federal taxes include income tax and FICA (Federal Insurance Contributions Act), which is your Social Security Taxes (taxed at 6.2% of your gross wages) and Medicare Taxes (taxed at 1.45% of your gross wages). How much Federal tax is withheld from your paycheck will depend on a few things, such as: how much money you make, how many jobs you have, what your filing status is, how many dependents you have, and how much of a refund you hope to get, if any. All this information is provided by you to your employer when you fill out Form W-4 at the start of your employment. If you ever want to change the amount of your federal tax withholding, you will need to fill out a new Form W-4.

One word of warning here: It is possible to indicate that you are “exempt” from federal tax withholding on Form W-4. What this means is that you expect you will owe no federal taxes come tax filing season and, therefore, no federal taxes will be withheld from your paycheck. If you are using this “exempt” status, please use it with caution as, if you are incorrect about not owing federal taxes, you will be in for a rather large tax bill in April and a potential underwithholding penalty.

State taxes will vary depending on the state you live in. Some states, like Florida, Texas, and Tennessee, have no state income tax. Other states, like California and New York, have both a state tax and a city or local tax. Overall, the state tax rates generally range from 0% to around 13%.

Other items that might affect your net wages are pretax deductions, such as healthcare premiums and traditional 401(k) contributions.

Let’s look at an example.

Bill is single, has no dependents, and is a resident of the state of Florida (no state income taxes). Bill’s annual gross salary is $60,000 (this is Bill’s only source of income for 2022). Bill’s employer offers a 401(k), but Bill has decided to opt out of this plan for now. Bill’s employer also provides medical and dental coverage at no cost to Bill. Bill gets paid twice a month. How much can Bill expect his take-home pay to be each pay period?

Let’s do the math.

Assuming Bill gets paid twice per month, that means Bill will receive 24 paychecks per year (12 months X 2 paychecks per month = 24 paychecks per year). Bill’s gross salary is $60,000 per year, which means his gross pay each paycheck is $2,500 ($60,000 per year/24 paychecks = $2,500 per paycheck). Bill thinks, “That’s great, $2,500 per paycheck!” But not so fast, Bill – those are your gross wages. What about your deductions?

Don’t forget the deductions.

Bill is required to pay FICA (Social Security and Medicare taxes), which are $155 and $36.25, respectively ($2,500 X .062 = $155 for Social Security and $2,500 X .0145 = $36.25 for Medicare).

For his federal income taxes, Bill hopes to “break even” come tax time (no balance due and no refund). At Bill’s current income level of $60,000, Bill’s tax liability for the year will be approximately $6,000. Per paycheck, Bill will have $250 withheld for Federal taxes ($6,000/24 pay periods = $250). Since Bill lives in a state with no income tax, he doesn’t have any state taxes withheld.

What does Bill get to take home?

While Bill’s gross wages are $2,500 per paycheck, Bill’s net wages will be $2,058.75 ($2,500 gross wages less $155 for Social Security tax less $36.25 for Medicare tax less $250 for Federal income tax). Bill is bringing home decent wages, but it is probably less than he thought it would be!

Knowing how much your take-home pay is important when it comes to budgeting, deciding how much rent you can afford, and figuring out how much you can afford to put away in savings. A strong understanding of your earnings will build a good foundation for future financial stability.