About IRS Notice CP504B | Notice of intent to seize (levy)

August 19, 2025 by Kate Ferreira

If you have received an IRS Notice CP504B – Notice of intent to seize (levy), you might be wondering why you received this letter, what it means, and what your options are. In this blog, we will answer those questions and provide some additional resources that may be available to you.

How do I know if I received an IRS Notice CP504B?

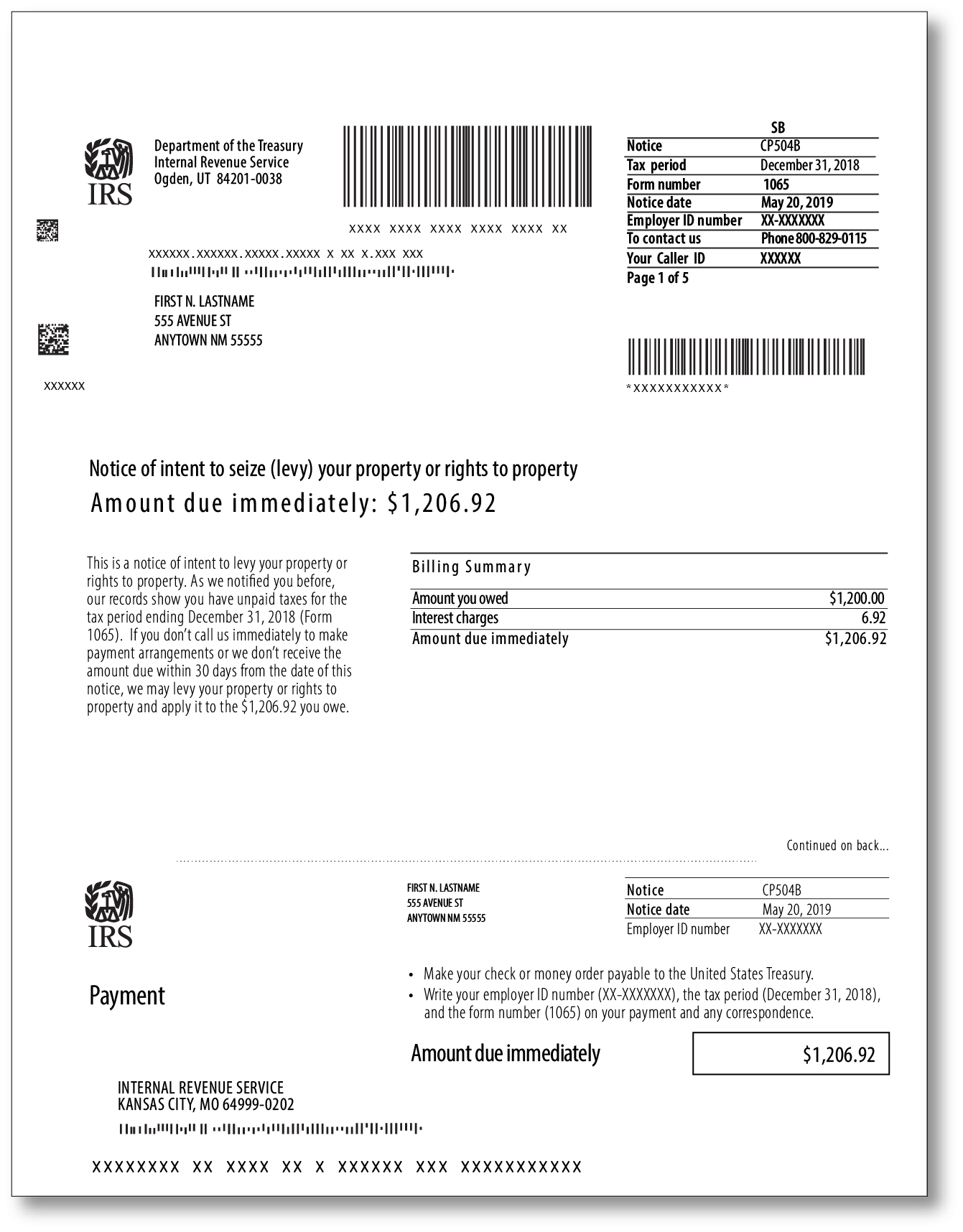

We have included a sample of an IRS Notice CP504B below. The best way to tell what type of notice you have is by looking in the top right-hand corner of the first page. The first page of your notice will also indicate the tax year and the amount of unpaid taxes in question.

Why did I receive this notice?

The IRS issues a Notice CP504B when there is an unpaid amount due on your account. This will never be the first notice the IRS issues – this is a final notice indicating that they will take additional collection action for the unpaid amounts owed if you do not 1) pay the balance due in full or 2) enter into a payment agreement within 30 days from the notice date.

What does this notice mean?

The IRS sends this letter notifying you that unless the amount owed is paid immediately, the IRS will begin to seize (levy) certain property or rights to property, and apply that towards the amount that you owe. The IRS can also begin searching for other assets in which to levy, or file a Federal Tax Lien, if they have not already done so. Additionally, this notice explains that there could be a denial or revocation of your United States Passport due to the balance due, especially if the amount is considered a seriously delinquent tax debt. Per the Fixing America’s Surface Transportation (FAST) Act legislation, the State Department can be prohibited from issuing or renewing passports for these delinquencies. For 2025, for the purpose of denying or revoking a taxpayer’s passport, a seriously delinquent tax debt is more than $64,000. This amount is adjusted yearly for inflation. For more information regarding passports, please visit IRS.gov/passports.

What do I do?

If you agree with the notice, you should pay the amount due by the due date on the notice, if you are able. The IRS offers several ways taxpayers can pay their balance due. Some of the options include:

- Scheduling a direct payment from your bank account with Direct Pay

- Paying through your IRS online account (For more information on how to set up an online account, please click here.)

- By debit or credit card or digital wallet (processing fees will apply)

- Same-day wire

- Enrolling in the Electronic Federal Tax Payment System (EFTPS)

If you would like to pay by check, we recommend contacting the IRS using the telephone number listed on your notice beforehand for further guidance. In March 2025, President Trump signed an Executive Order ceasing the Treasury from issuing and receiving payment checks. This means the IRS will be phasing out the receipt of paper checks. Currently, this mandate is set to go into effect on September 30, 2025. It is likely that certain exceptions will be made for those who are unable to make an electronic payment, but this information is not yet available.

If you agree with the notice but cannot pay the entire amount in full, call the IRS using the phone number listed at the top of the notice. By calling, you can talk to an IRS representative to see if you qualify for an installment agreement.

If you do not agree with the notice, we recommend contacting an experienced, licensed tax professional so they can investigate and advise on the next steps. At TaxAudit, we do have a Tax Debt Relief team that offers no obligation consultations for these types of notices. If you decide to work with us, we can review your situation, respond to the IRS if needed, and come up with a resolution. Our goal is to ensure you pay no more tax than what you rightfully owe.

If you decide not to contact us here at TaxAudit, that’s okay! We still recommend having a tax professional look at your situation to verify whether the IRS is correct.

What if I have already paid or set up an installment agreement?

If you have already paid the tax listed on the notice or have set up an installment agreement with the IRS, you will still want to call the number printed on the notice to make sure that your account is reflecting these payments, and the installment agreement is on record.

What happens if I choose not to pay or contact the IRS?

Once the due date of the IRS Notice CP504B has passed, you may receive an additional notice from the IRS that gives you the right to a Collection Due Process hearing before the IRS Independent Office of Appeals. If you receive a “Notice of Intent to Levy and Notice of Your Right to a Hearing,” it is imperative you request a Collection Due Process (CDP) or Equivalent Hearing timely, as a CDP hearing preserves your right to still petition the Tax Court, if you disagree with the decision Appeals renders. Form 12153, Request for a Collection Due Process or Equivalent Hearing, should be filed within 30 days of the notice date.

If you do not pay or contact the IRS, they will then begin to seize (levy) your property or rights to property. Additionally, if not already done so, the IRS can also file a Notice of Federal Tax Lien on your property. Generally, liens are a matter of public record, and if a lien is placed on property like your home, it may make it difficult to borrow against the home or refinance the mortgage.

What can the IRS seize (levy)?

The IRS can seize (levy) property or rights to property that include:

- Wages, real estate commissions, and other income

- Bank accounts

- Business assets

- Personal assets, such as your car and home

- Social Security benefits

- Retirement income

- Future Federal or State tax returns

Do I have any other options?

TaxAudit offers Tax Debt Relief for those who have received notices such as an IRS CP504B. Our tax professionals will look at your specific financial situation and come up with a plan to help resolve your tax debt. For more information or for a free tax debt relief consultation, click here.