If you’ve ever felt invisible or like no one is paying attention to you, don’t worry! The IRS knows you are alive and well. It’s possible they may even send you letters.

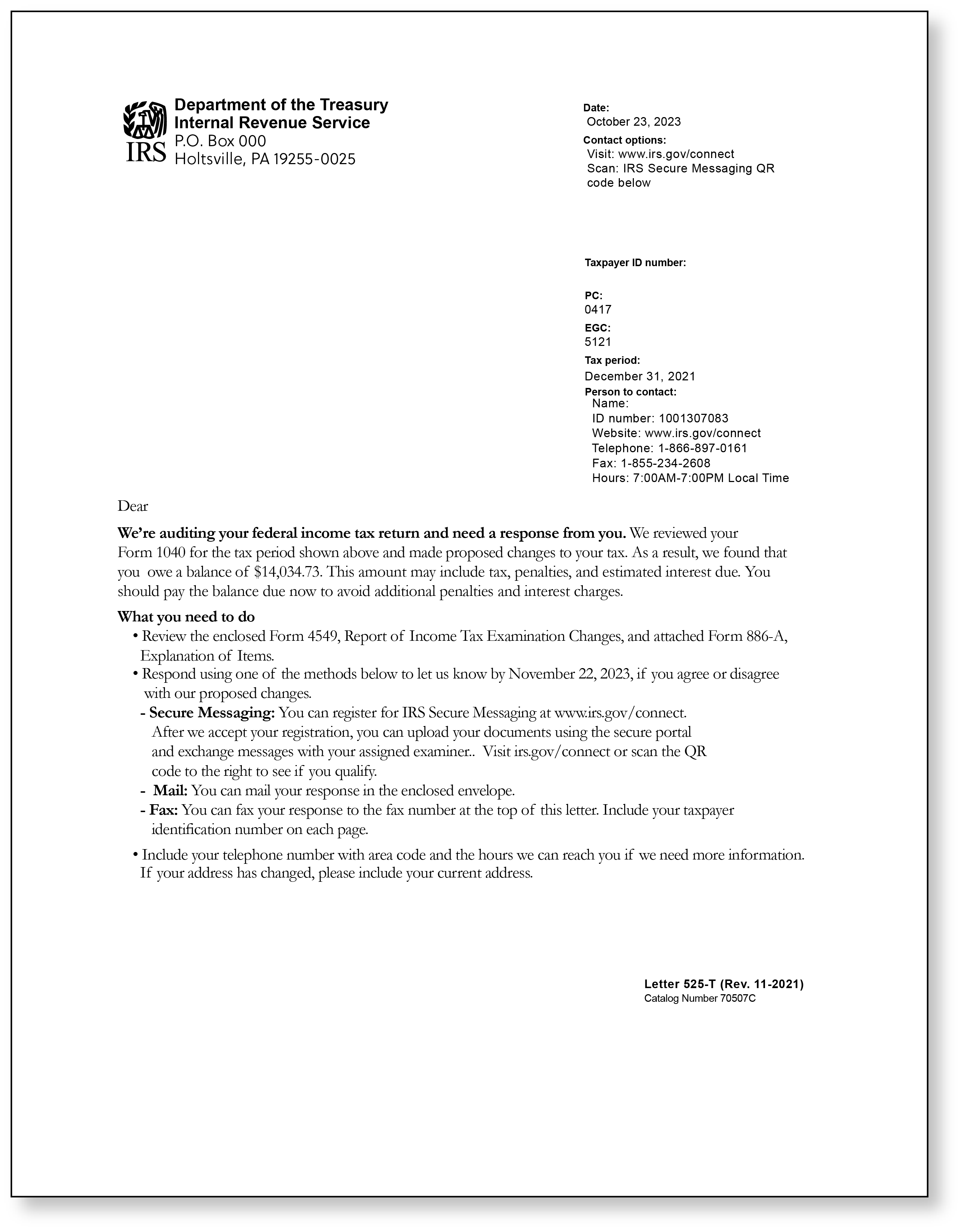

Letter 525 (Ltr525) is a letter the IRS sends taxpayers to let them know that someone has “done a once over” of their tax return. A wise taxpayer should proceed with caution, yet swiftly, from this point forward.

The Basics

The basics of this letter are:

- The IRS has reviewed an area of your return and has questions about particular items reported by you. This is what is known as an audit. The Ltr525 gets mailed out for one of two reasons: 1) they sent you an earlier letter asking for documents that you then provided, or 2) they sent you an earlier letter asking for documents to which you did not respond at all. The reasons for not responding are many, but the IRS will continue moving along with their audit either way, and that is why we now have this letter.

-

- The IRS thinks you should pay this, this, that, and the other thing for a proposed tax amount due. After their first letter requesting documents, they are now explaining their review of the documents you provided and whether they agreed with them or not. Or, if you have not provided any documents yet, they are giving you the opportunity to respond with those records before making permanent changes.

It is important to note that, with these types of letters, the IRS expects a response in 30 days – so don’t file this one away for later. Now is the time to start taking action.

So, what should you do first?

Before you start going through the filing cabinets, confirm a few things on the notice first. Here are some of the things to look for:

- Check the taxpayer’s name, address, and social security number on the top half of the first page. Is it you? Is it your neighbor? Is it someone with a similar name to yours but not you?

- Note: Unfortunately, you won’t be able to claim it isn’t you just because the IRS sent it to an old address, or the mail carrier left it at your neighbor’s house. It is still your letter. Sorry, not getting out of it that easy.

- Tax year: Did you file your Tax Return for the year to which the IRS is referring? Now is the time to find that return – pull it out of the file cabinet or download it – whatever it is you need to do to get your hands on it.

- Now let’s read through the body of the letter and additional pages. There will be pages that indicate what sort of documentation the IRS wants from you. It may say things like receipts or bank records to show proof of expenses. They may ask for logs, like a mileage or travel log. They may ask for supporting information about dependents claimed on the return. They may even throw in a questionnaire for you to complete. The important thing is that you take your time to read through this section carefully so you can supply the IRS with what they have asked.

- Some of these pages should include the number “886” in the top left corner. These pages will list the tax return areas the IRS is reviewing. Look at what the IRS is explaining and the reason the IRS gives for a potential adjustment. Review each area listed one at a time. Looking at each item, consider if you have the documentation for the amount you put on your Tax Return. Did you have it at one time? Did you use it to line the hamster cage? Or my old favorite: did the dog eat it? The IRS expects you to keep all related documents with the tax return they are reported on.

- You will also want to find Form 4549, which looks like some sort of spreadsheet. Get out a calculator and check the math. The adjustments you see are what the IRS is proposing. Did the IRS add and subtract correctly? It is important for you to verify this.

-

- The next step is to gather all the documents the IRS requested. Compile everything in a neat and orderly fashion. Keep similar expense items or documents together, preferably in chronological order for the year. Then make clear, readable copies of everything. NEVER send your original documents to the IRS. They will not return them. Always send copies.

Now that you have more information about where you stand, what do you do?

Do you agree with the changes?

Ouch. I know it hurts. But are they right?

If they are, sign and return the adjustment form (that’s Form 4549). And if you owe additional tax, you can either pay the amount due by mailing a check to the address indicated or go to IRS.gov to make your payment online. The latter is probably the safest and easiest payment option. You can use your bank routing and account number with no charge. If you use a credit card, there will be a processing fee. IRS.gov also allows you to set up a payment plan if you need to pay in installments.

You disagree with some or all of the changes?

It is best to document what you believe is wrong in a letter and supply documents that show what happened. Consider having someone else review it. Then, when you are ready to send it, consider your options. If you choose to mail it, use the address listed on the top left of the first page of the letter. It is recommended you head down to the post office and send it via certified mail so you can have tracking and proof of delivery. You can also fax the response in if it is not a substantial number of pages, or you may be able to upload your package to the IRS via their website. The first two pages of the notice will have information about uploading your documents, if the IRS is providing that option. This would be the most expedient way to supply your documents for review.

Regardless of the option you choose, be sure you are providing the response package by the due date – 30 days from the date on the letter. If it turns out you need a bit more time to get everything together, you can request a one-time extension of up to 30 days by calling the IRS at the number provided on the notice.

Once you’ve sent off your documents, it’s important to remember that the time to hear back from the IRS can be many months. Pack your patience but keep an eye on your mailbox. The IRS will only contact you through the mail or through their online portal if you have an online account with them. They will not text you or email you asking for more documents or personal information.

And finally, if all of this seems like too much or at least more than you want to handle on your own, you can get help and representation. The Tax Professionals at

TaxAudit not only specialize in providing representation during an audit but can also inform you of your options should you wind up with a balance due once all is said and done. They are here to alleviate the stress of the audit, provide guidance and education, and handle all communications with the IRS on your behalf.

Help is never far away. You can reach out to TaxAudit by calling 1-800-92-AUDIT (1-800-922-8348).